UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities

Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant |  |

Filed by a Party other than the Registrant |

| Check the appropriate box: | |

|

Preliminary Proxy Statement |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material under §240.14a-12 |

ANTERO MIDSTREAM CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | |

|

No fee required |

|

Fee paid previously with preliminary materials |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

JUNE 7, 2022 8:00 A.M. Mountain Time

Antero Principal Executive Offices 1615 Wynkoop Street |

|

NOTICE of 2022 Annual Meeting |

The 2022 Annual Meeting of Stockholders of Antero Midstream Corporation (“Antero Midstream”) will be held online on Tuesday, June 7, 2022, at 8:00 A.M. Mountain Time. The Annual Meeting is being held for the purposes listed below:

AGENDA

| 1. | Elect the two Class III members of Antero Midstream Corporation’s Board of Directors (the “Board”) named in this Proxy Statement to serve until Antero Midstream’s 2025 Annual Meeting of Stockholders, |

| 2. | Ratify the appointment of KPMG LLP as Antero Midstream’s independent registered public accounting firm for the year ending December 31, 2022, |

| 3. | Approve, on an advisory basis, the compensation of Antero Midstream’s named executive officers, |

| 4. | Transact other such business as may properly come before the meeting and any adjournment or postponement thereof. |

These proposals are described in the accompanying proxy materials.

RECORD DATE

April 18, 2022

By order of the Board of Directors,

|

Yvette K. Schultz

Chief Compliance Officer, Senior Vice President—Legal, General Counsel and Secretary

WHO MAY VOTE:

You will be able to vote at the Annual Meeting only if you were a stockholder of record at the close of business on April 18, 2022, the record date for the Annual Meeting. The Board requests your proxy for the Annual Meeting, which will authorize the individuals named in the proxy to represent you and vote your shares at the Annual Meeting or any adjournment or postponement thereof.

HOW TO RECEIVE ELECTRONIC DELIVERY OF FUTURE ANNUAL MEETING MATERIALS:

Pursuant to rules adopted by the Securities and Exchange Commission, we have elected to provide access to our proxy solicitation materials electronically, rather than mailing paper copies of these materials to each stockholder. Beginning on April 28, 2022, we will mail to each stockholder a Notice of Internet Availability of Proxy Materials with instructions on how to access the proxy materials, vote, or request paper copies.

IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 7, 2022:

This Notice of Annual Meeting and Proxy Statement and the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 (the “Form 10-K”) are available on our website free of charge at www.anteromidstream.com in the “SEC Filings” subsection of the “Investors” section.

YOUR VOTE IS IMPORTANT

Your vote is important. We urge you to review the accompanying Proxy Statement carefully and to submit your proxy as soon as possible so that your shares will be represented at the meeting.

| REVIEW

YOUR PROXY STATEMENT AND VOTE IN ONE OF FOUR WAYS: |

|

|

|

| ||||

| If you are a registered stockholder as of the record date, you may vote your shares or submit a proxy to have your shares voted by one of the following methods: | INTERNET Use the website listed on the Notice of Internet Availability (the “Notice”) |

BY TELEPHONE Use the toll-free number listed on the Notice |

BY MAIL Sign, date and return your proxy card in the provided pre-addressed envelope |

DURING THE ANNUAL MEETING Vote online during the Annual Meeting. See page 10 of the Proxy Statement for instructions on how to attend online |

|

- 2022 Proxy Statement 2 |

|

- 2022 Proxy Statement 3 |

This summary highlights information contained in this Proxy Statement. This proxy summary does not contain all of the information you should consider, and you should read this entire Proxy Statement before voting.

Some highlights of our sustainability and corporate responsibility efforts appear below. Please visit https://www.anteromidstream.com/community-sustainability for more information and a link to our most recent ESG report.

Human Capital

The largest contribution in making us a responsible and sustainable company comes from our talented and experienced employees. We encourage our employees to embrace our values, and work every day to make these values apparent in all that we do.

| • | The safety and security of our people and the integrity of our operations are our top priorities. Our health and safety compliance program seeks to protect our workforce and the communities in which we operate by setting a goal of zero incidents, zero harm, zero compromise. We have well developed and thoughtful processes for identifying and mitigating safety risks: |

| – | Identification – behavior-based safety programs, job safety analysis, emergency response drills and contractor vetting through a reputable third-party vendor | |

| – | Mitigation – contractor safety improvement plans, root cause analyses, risk ranking/mitigation reviews for every project, pre-job safety startup reviews, and a library of over 30 individual training courses |

| • | Our success as a company is not measured only by our financial results but also by how we treat our employees. We seek to help our people enjoy healthier lives, achieve educational goals, and pursue economic opportunities for themselves and their families by offering competitive compensation and benefits, including: |

| – | Healthcare coverage – medical and prescription, dental and vision | |

| – | Financial assistance – health savings accounts, dependent care flexible spending account coverage and 401(k) plan with matching | |

| – | Insurance – basic life, accidental death and disability, short-term disability and long-term disability coverage | |

| – | Lifestyle – employee assistance program, holidays and personal choice days, paid vacation and sick leave, company-paid parental leave, subsidized gym memberships and free parking and public transportation |

| • | In response to the COVID-19 pandemic, and as further highlighted in our Annual Report on 10-K for the fiscal year ending December 31, 2021, we implemented significant changes that we believe to be in the best interest of our employees: |

| – | Having our office employees work from home to the extent they are able | |

| – | Implementing additional safety measures, including required weekly or bi-weekly testing and other recommended public health measures for our field employees continuing critical on-site work | |

| – | Continuing to monitor the COVID-19 environment in order to (i) protect the health and safety of our employees and contract workers and (ii) determine when a return to an in-office working arrangement will be appropriate |

|

- 2022 Proxy Statement 4 |

| • | Doing the right thing is essential to our culture, and we communicate to our employees that it is essential to their, and our, long-term success. To that end, we conduct an annual, company-wide ethics and compliance training program that covers, among other things, ethical business practices, insider trading, and anti-discrimination and anti-harassment. |

| • | We respect human rights and promote them in our supply chain by, among other things, adhering to our internal policies, including: |

| – | Supplier Code of Conduct – promotes the fair and ethical treatment of suppliers, contractors, independent consultants and other parties that Antero Midstream works with through a set of guidelines focusing on equal opportunity, workplace safety, protection of the environment, compensation and protection of proprietary information and requires the protection of human rights and respect for freedom of association | |

| – | Human, Labor and Indigenous Rights Policy – promotes respect of human rights through compliance with applicable national and local laws as well as pertinent trends and norms with respect to compensation, discrimination, health and safety, community and indigenous peoples; prohibits child labor, forced labor and human trafficking; recognizes freedom of association; prohibits workplace harassment, discrimination, and misuse of employer power, in line with applicable laws related to all of these topics; and provides access to a hotline for reporting concerns or grievances |

Community Engagement

We are committed to enhancing the communities in which we live and work. Recent highlights of our community engagement include:

| • | Together with Antero Resources Corporation (“Antero Resources”): | |

| – | Maintained a Community Relations hotline and resolved over 98% of community relations inquiries submitted from 2020 to 2022 | |

| – | Improved community infrastructure in West Virginia and Ohio through $259 million in improved road and infrastructure upgrades since 2013 | |

| – | Donated $100,000 to WVU Medicine Children’s Hospital | |

| • | Through the Antero Foundation, in 2021, Antero Midstream and Antero Resources: | |

| + $665K | 1,284 | |||

| donated to philanthropic and community endeavors, including to food pantries and food banks in West Virginia and Ohio | community service hours logged

|

|||

| |

| – | Established an employer matching campaign to assist the Colorado communities affected by the Marshall fires | |

| – | Contributed meaningful employment opportunities in the Appalachian Region | |

| – | Donated much-needed funds and equipment to healthcare providers in response to the COVID-19 pandemic |

Diversity

We recognize the importance of supporting and promoting diversity in our workplace. Our Diversity and Inclusion Policy promotes diversity and equal opportunity in the hiring process by prohibiting all forms of unlawful discrimination based on age, race, ethnicity, religion, sex, gender identity and other impermissible factors. In addition, we identify qualifications, attributes, and skills that are important to be represented on the Board. We consider individuals of all backgrounds, skills and viewpoints when seeking employees and candidates for Board service.

As set forth in our Diversity and Inclusion Policy and our Nominating & Governance Committee Charter, we view diversity broadly to include diversity of backgrounds, skills and viewpoints as well as traditional diversity concepts such as race, gender, national origin, religion or sexual orientation or identity. In 2022, we amended our Diversity and Inclusion Policy and our Nominating and Governance Committee Charter to require that each pool of candidates to be considered to fill a vacancy on the Board shall include at least one individual who would be considered diverse based on traditional diversity concepts.

|

- 2022 Proxy Statement 5 |

Pursuant to our Diversity and Inclusion Policy, we expect recruiters to continue to provide us with a diverse pool of candidates, and our hiring process considers the value of diversity. We monitor employee metrics in areas such as gender and ethnicity.

In January 2022, Yvette K. Schultz was promoted to be an executive officer, to serve as our Chief Compliance Officer, Senior Vice President—Legal, General Counsel and Secretary. We have also recently promoted several other women to be officers, including to serve as Chief Accounting Officer and Senior Vice President—Accounting, Senior Vice President—Operations, Senior Vice President—Geology and Vice President—Production.

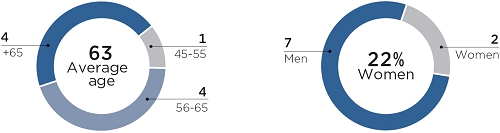

As of December 31, 2021:

| 23% | 2 | 21% | |||||

| of our employees are women | out of seven independent directors are women | of our directors, senior vice presidents, and vice presidents are women | |||||

Governance

Our Board has ultimate oversight over the company’s operational performance and ethical conduct. This includes, in partnership with our executive leadership team, managing our risk mitigation and ESG efforts. Highlights of our corporate governance program include:

| • | Director independence and Board composition |

| – | Seven out of nine directors are independent | |

| – | We have an independent lead director | |

| – | Each Board committee is chaired by an independent director | |

| – | Our Nominating & Governance Committee is comprised entirely of independent directors | |

| – | The ages of our directors range from 47 to 71 years old, and the average director tenure is three years |

| • | Focus on ESG matters |

| – | We have an ESG Committee of the Board that guides and governs our ESG initiatives | |

| – | We have an ESG Advisory Council, made up of leaders from across the organization, that develops a centralized, systematic approach for identifying, managing and communicating ESG risks and opportunities | |

| – | A portion of executive compensation is tied to ESG performance | |

| – | 100% of employees completed training for our Human, Labor and Indigenous Rights Policy, our Diversity and Inclusion Policy and our Supplier Code of Conduct |

| • | Valuing investor feedback and alignment with stockholders |

| – | We proactively engage with stockholders and other stakeholders regarding ESG performance | |

| – | Our executive compensation program and robust stock ownership guidelines applicable to directors and executives were thoughtfully designed to incentivize the maximization of shareholder value and promotion of ESG performance | |

| – | Our corporate policies generally prohibit hedging or pledging company stock |

Environment and Safety(1)

We believe safety and environmental stewardship are intrinsically linked. Our goal of Zero incidents, Zero harm, Zero compromise empowers every employee to make the safest decisions to protect our people and the planet. Our dedicated staff of environmental professionals manage our health, safety, security and preservation of the environment (“HSSE”) programs and are committed to our performance as a safe and sustainable energy company. In addition, stewardship of the environment is a fundamental value in our overall business strategy. Highlights of our 2021 HSSE program include:

| (1) | Data retrieved from Antero Midstream’s and Antero Resources’ 2020 ESG Reports or calculated from the 2020 ESG Reports and public disclosures. Antero Resources’ and Antero Midstream’s emission intensity is based on the total GHG emissions reported to the EPA under Subpart W of the Greenhouse Gas Reporting Rule Program. Antero Resources’ and Antero Midstream’s methane leak loss rate performance is derived from average data derived from OneFuture. GHG intensity includes companies’ midstream and/or downstream operations. |

|

- 2022 Proxy Statement 6 |

|

|

| ||

| 98% of the fresh water used by Antero Resources was transferred by Antero Midstream pipeline, eliminating approximately 32 million miles of truck traffic and avoiding approximately 14,000 metric tons of carbon dioxide emissions | 86% of flowback and produced water gathered was reused or recycled | We have one of the lowest methane leak loss rates in the industry at 0.015% | ||

| Our employees completed 4,900 health and safety training hours | ||||

| • | Our ESG disclosure standards are aligned with those of the Sustainability Accounting Standards Board and the Task Force on Climate-Related Financial Disclosures |

| • | We announced goals to achieve a 100% reduction in pipeline emissions by 2025 and to achieve Net Zero Scope 1 (direct) and Scope 2 (indirect from the purchase of energy) emissions by 2050 through implementation of emission reduction practices and technologies and the purchase of carbon credits |

| • | We continue to be an industry leader with one of the lowest rates for both lost time injuries and OSHA recordable injuries, achieving a lost time incident rate of 0.061 for employees and contractors in 2020 |

| • | We provided regulatory compliance programs and workshops for contractors |

We are an active member of the U.S. EPA Natural Gas STAR program, ONE Future, The Environmental Partnership, and the Colorado State University’s Methane Emissions Technology Evaluation Center. Our participation in these organizations and programs provides us with information and resources as we continue our efforts to reduce GHG emissions.

In 2019, we significantly enhanced shareholder rights and our corporate governance practices. In March of 2019, equity holders of Antero Midstream Partners LP (“AMLP”) and Antero Midstream GP LP (“AMGP”) approved proposals to combine the two companies and convert the resulting company from a limited partnership into a corporation. The transaction and resulting governance structure was approved by the boards of directors and conflicts committees of both AMLP and AMGP, was recommended by both ISS and Glass Lewis and was overwhelmingly approved by equity holders of AMLP and AMGP. In connection with the transaction, our shareholders overwhelmingly approved a proposal to convert from a limited partnership to a corporation and adopt a certificate of incorporation that enhanced shareholders’ rights. Approximately 99% of votes cast were in favor of converting from a limited partnership to a corporation and adopting our current certificate of incorporation. While the certificate of incorporation approved by shareholders contains provisions for a classified board of directors and a supermajority vote for certain amendments, at the time ISS recommended shareholders vote for the conversion and adoption of the certificate of incorporation, noting that support for the proposal was warranted in part due to the valuable governance protections and enhanced rights that shareholders would experience.

|

- 2022 Proxy Statement 7 |

Antero Midstream and the Board value input from stockholders, and we are committed to maintaining an open dialogue to receive feedback on important items. In 2021, we met with stockholders to discuss governance-related issues, including environmental and social matters.

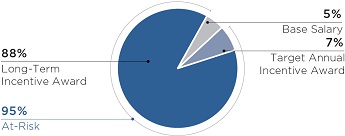

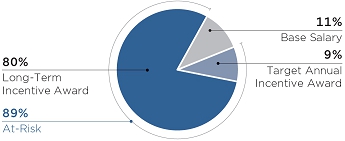

Below is a summary of key components and decisions regarding our executive compensation program for 2021:

| • | Long-term incentive compensation awards vest over periods of several years to reward sustained Antero Midstream performance over time. |

| • | Long-term compensation awards for our Named Executive Officers increased in 2021 due to the Company’s continued financial improvement and desire to incentivize long-term performance. |

| • | Executive compensation is in part tied to a qualitative assessment of ESG performance by the Compensation Committee, with input from the ESG Committee, where appropriate, which will include non-financial performance goals to: |

| – | Continue progress towards meeting our 2025 climate goals | |

| – | Demonstrate leading safety performance compared to industry peers | |

| – | Reduce the number of reportable spills | |

| – | Provide a safe environment for our employees and contractors as we navigate the challenges of the Covid-19 pandemic | |

| – | Enhance reporting on company community engagement and relations efforts | |

| – | Conduct a climate risk analysis as required by the Taskforce on Climate-related Financial Disclosures | |

| – | Create an inter-departmental ESG Advisory Council to manage ESG challenges and opportunities throughout the organization | |

| – | Require employee training requirements with respect to the following company policies: Human Labor and Indigenous Rights; Diversity and Inclusion; Supplier Code of Conduct |

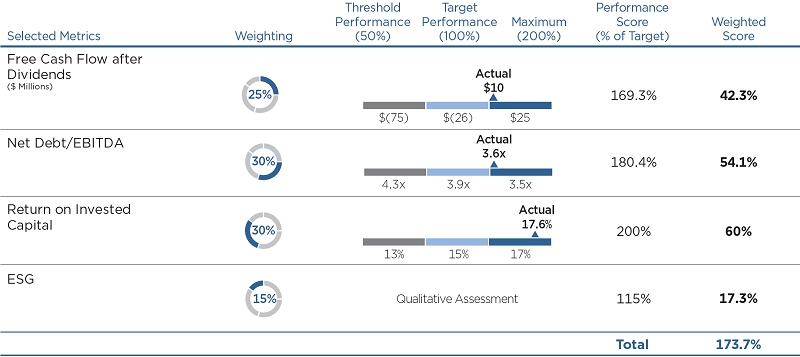

| • | The annual incentive plan for 2021 included metrics we felt were key to value creation. These included free cash flow after dividends, leverage goals, return on invested capital and ESG goals. We are proud of our results with a payout of 173% of target. The full details of our annual incentive plan metrics, goals and results are shown on page 41 of the proxy. |

| • | Base salary levels for the Named Executive Officers were increased in 2021 to target median base salary levels for similarly situated executives in the peer group. |

| • | Each of the Named Executive Officers is employed at-will and none of the Named Executive Officers is party to an employment agreement, severance agreement or change in control agreement. |

|

- 2022 Proxy Statement 8 |

| Director | Director | Committee Memberships | ||||||||||||||||||

| Name | Class | Age | Occupation | Since | Independent | Audit | Comp | Nom & Gov | Conflicts | ESG | ||||||||||

| Peter A. Dea | Class I | 68 | Co-Founder and Executive Chairman of Confluence Resources LP | 2019 |  |

|

|

|||||||||||||

| W. Howard Keenan, Jr. | Class I | 71 | Member of Yorktown Partners LLC | 2019 |  |

|

|

|||||||||||||

| Janine J. McArdle | Class I | 61 | Founder and CEO of Apex Strategies, LLC | 2020 |  |

|

| |||||||||||||

| Michael N. Kennedy | Class II | 47 | SVP – Finance of Antero Midstream | 2021 |  | |||||||||||||||

| Brooks J. Klimley | Class II | 65 | Founder and President of Brooks J. Klimley & Associates | 2019 |  |

|

|

| ||||||||||||

| John C. Mollenkopf | Class II | 60 | Retired Chief Operating Officer of MarkWest operations of MPLX GP LLC | 2019 |  |

|

| |||||||||||||

| Paul M. Rady | Class III | 68 | Chairman of the Board and Antero Midstream Chief Executive Officer | 2019 | ||||||||||||||||

| David H. Keyte | Class III | 66 | Chairman and Chief Executive Officer of Caerus Oil and Gas LLC | 2019 |  |

|

|

|

||||||||||||

| Rose M. Robeson | Class III | 61 | Retired Chief Financial Officer of DCP Midstream GP, LLC | 2019 |  |

|

|

|

||||||||||||

|

Chairperson |

Board Composition Highlights

|

- 2022 Proxy Statement 9 |

We are pleased this year to conduct the Annual Meeting solely online via the Internet through a live webcast and online stockholder tools. We are conducting the Annual Meeting virtually because we believe a virtual format makes it easier for stockholders to attend and participate. Moreover, this format empowers stockholders around the world to participate at no cost.

Here are several ways our virtual format will enhance stockholder access and participation and protect stockholder rights:

| • | We Encourage Questions. Stockholders can submit questions for the meeting online in advance or live during the meeting, following the instructions below. During the meeting, we will answer as many appropriate stockholder-submitted questions as time permits. Following the Annual Meeting, we will publish an answer to each appropriate question we received on our Investor Relations website at www.anteromidstream.com/investors as soon as practical. |

| • | We Believe in Transparency. Although the live webcast is available only to stockholders at the time of the meeting, we will post a webcast replay, the final report of the inspector of election, and answers to all appropriate questions asked by stockholders in connection with the Annual Meeting to our Investor Relations website at www.anteromidstream.com/investors. |

| • | We Proactively Take Steps to Facilitate Your Participation. During the Annual Meeting, we will offer live technical support for all stockholders attending the meeting. |

Meeting Admission

You are entitled to attend and participate in the virtual Annual Meeting only if you were a stockholder as of the close of business on April 18, 2022 or if you hold a valid proxy for the Annual Meeting. If you are not a stockholder, you may still view the meeting after the recording has been posted on our Investor Relations website.

Attending Online. If you plan to attend the Annual Meeting online, please read the instructions below so you understand how to gain admission. If you do not comply with these procedures, you will not be able to participate in the Annual Meeting.

Stockholders may participate in the Annual Meeting by visiting www.virtualshareholdermeeting.com/AM2022. If you are a stockholder of record, you will need he control number on your Notice of Internet Availability (the “Notice”) or proxy card to log in. For beneficial stockholders who do not have a control number, instructions to gain access to the meeting may be provided on the voting instruction card you receive from your broker, bank, or other nominee.

Stockholders of record hold shares directly with American Stock Transfer and Trust Company LLC.

“Beneficial” or “street name” stockholders hold shares through a broker, bank, or other nominee.

Please allow ample time to check in to the virtual meeting. The site will be available beginning at 7:45 A.M. Mountain Time. We will have technicians ready to assist if you have difficulties accessing or participating in the virtual meeting at (844) 986-0822 (if you are in the U.S.) or (303) 562-9302 (if you are outside the U.S.).

Asking Questions. Stockholders who wish to submit a question in advance may do so on our Annual Meeting website, www.virtualshareholdermeeting. com/AM2022, which will be open 15 minutes before the Annual Meeting. Stockholders also may submit questions live during the meeting. We plan to reserve up to 20 minutes for appropriate stockholder questions to be read and answered by Company personnel during the meeting, but we will only address questions that are germane to the matters being voted on at our Annual Meeting. Stockholders can also access copies of this Proxy Statement and annual report at our Annual Meeting website.

|

- 2022 Proxy Statement 10 |

Voting Before or During the Meeting

Whether you are a stockholder of record or a beneficial stockholder, you may direct how your shares are voted without participating in the Annual Meeting. We encourage stockholders to vote well before the Annual Meeting, even if they plan to attend. If you are a registered stockholder as of the record date, you may vote your shares or submit a proxy to have your shares voted by one of the following methods:

| • | Online. Submit a proxy electronically using the website listed on the Notice. You will need the control number from your Notice to log on to the website. Internet voting facilities will be available until 11:59 p.m., Mountain Time, on Monday, June 6, 2022. |

| • | By Telephone. Request the proxy materials and submit a proxy by telephone using the toll-free number listed on the Notice. You will need the control number from your Notice when you call. Telephone voting facilities will be available until 11:59 p.m., Mountain Time, on Monday, June 6, 2022. |

| • | By Mail. You may request a hard copy proxy card by following the instructions on the Notice. You can submit your proxy by signing, dating and returning your proxy card in the provided pre-addressed envelope. |

| • | In Person Online. If you are a registered stockholder and you attend the Annual Meeting online, you can vote via the Internet during the meeting. Follow the instructions at www.virtualshareholdermeeting.com/AM2022 to vote during the meeting. |

If you are a beneficial stockholder, you will receive instructions from the holder of record that you must follow for your shares to be voted. Most banks and brokers offer Internet and telephone voting. If you do not give voting instructions, your broker will not be permitted to vote your shares on any matter that comes before the Annual Meeting except the ratification of our auditors.

As of the record date, 478,256,108 shares of common stock were outstanding and entitled to be voted at the Annual Meeting. Holders of shares of our 5.5% Series A Non-Voting Perpetual Preferred Stock (the “Series A Preferred Stock”) are not entitled to vote such shares at the Annual Meeting.

Revoking Your Proxy or Changing Your Vote. Stockholders of record may revoke their proxy at any time before the electronic polls close by submitting a later-dated vote via the Internet, by telephone or by mail; by delivering instructions to our Secretary before the Annual Meeting commences; or by voting online in person during the Annual Meeting. Simply attending the meeting will not affect a vote that you have already submitted.

Beneficial stockholders may revoke any prior voting instructions by contacting the broker, bank, or other nominee that holds their shares prior to the Annual Meeting or by voting online during the meeting.

This Proxy Statement includes “forward-looking statements.” Such forward-looking statements are subject to a number of risks and uncertainties, many of which are not under Antero Midstream’s control. All statements, except for statements of historical fact, made in this Proxy Statement regarding activities, events or developments Antero Midstream expects, believes or anticipates will or may occur in the future, such as statements regarding Antero Midstream’s ability to achieve its Net Zero goals, are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All forward-looking statements speak only as of the date hereof. Although Antero Midstream believes that the plans, intentions and expectations reflected in or suggested by the forward-looking statements are reasonable, there is no assurance that these plans, intentions or expectations will be achieved. Therefore, actual outcomes and results could materially differ from what is expressed, implied or forecast in such statements. Except as required by law, Antero Midstream expressly disclaims any obligation to and does not intend to publicly update or revise any forward-looking statements.

In addition, many of the standards and metrics used in preparing this Proxy Statement and the 2020 ESG Report continue to evolve and are based on management expectations and assumptions believed to be reasonable at the time of preparation but should not be considered guarantees. The standards and metrics used, and the expectations and assumptions

|

- 2022 Proxy Statement 11 |

they are based on, have not been verified by any third party. In addition, while we seek to align these disclosures with the recommendations of various third-party frameworks, such as the Task Force on Climate-Related Financial Disclosures, we cannot guarantee strict adherence to these framework recommendations. Additionally, our disclosures based on these frameworks may change due to revisions in framework requirements, availability of information, changes in our business or applicable governmental policy, or other factors, some of which may be beyond our control. The calculation of methane leak loss rate disclosed in the 2020 ESG Report is based on ONE Future protocol, which is based on the EPA Greenhouse Gas Reporting Program. With respect to its pipeline emissions goal, Antero Midstream anticipates achieving a 100% reduction in pipeline emissions by 2025 and Net Zero Scope 1 and Scope 2 emissions through 2050 through operational efficiencies and the purchase of carbon offsets; however, such goals are aspirational and we could face unexpected material costs as a result of our efforts to meet these goals. Moreover, given uncertainties related to the use of emerging technologies, the state of markets for and availability of verified quality carbon offsets, we cannot predict whether or not we will be able to meet these goals in a timely fashion, if at all. Scope 1 emissions are the Company’s direct greenhouse gas emissions, and Scope 2 emissions are the Company’s indirect greenhouse gas emissions associated with the purchase of electricity, steam, heat or cooling.

This Proxy Statement and the ESG Report contain statements based on hypothetical or severely adverse scenarios and assumptions, and these statements should not necessarily be viewed as being representative of current or actual risk or forecasts of expected risk. These scenarios cannot account for the entire realm of possible risks and have been selected based on what we believe to be a reasonable range of possible circumstances based on information currently available to us and the reasonableness of assumptions inherent in certain scenarios; however, our selection of scenarios may change over time as circumstances change. While future events discussed in this Proxy or the ESG Report may be significant, any significance should not be read as necessarily rising to the level of materiality of certain disclosures included in Antero Midstream’s SEC filings. The goals discussed in this Proxy Statement are aspirational; we could face unexpected material costs as a result of our efforts to meet these goals and may ultimately meet such goals through the purchase of offsets or credits and not reductions in our actual GHG emissions. Moreover, given uncertainties related to the use of emerging technologies, the state of markets for and the availability of verified quality carbon offsets, we cannot predict whether or not we will be able to meet these goals in a timely fashion, if at all. Moreover, with regards to our participation in, or certification under, various frameworks, we may incur certain costs associated with such frameworks and cannot guarantee that such participation or certification will have the intended results on our or our products’ ESG profile

Antero Midstream cautions you that these forward-looking statements are subject to all the risks and uncertainties incident to our business, most of which are difficult to predict and many of which are beyond Antero Midstream’s control. These risks include, but are not limited to, the risks described under the heading “Item 1A. Risk Factors” in Antero Midstream’s Annual Report on Form 10-K for the year ended December 31, 2021.

|

- 2022 Proxy Statement 12 |

The Board is currently comprised of nine directors, divided into three classes. Directors in each class are elected to serve for three-year terms and until they are re-elected, their successors are elected and qualified, or they resign or are removed. Each year, the directors of one class stand for re-election as their terms of office expire. Ms. Robeson will not stand for re-election at the 2022 Annual Meeting. Accordingly, Ms. Robeson’s term as a member of the Board will expire immediately prior to the 2022 Annual Meeting, at which time the size of the Board will be reduced from nine to eight directors. The Board expresses its gratitude to Ms. Robeson for her many contributions during five years of service on the Board. Based on recommendations from our Nominating & Governance Committee, the Board has nominated the following individuals for election as Class III directors of Antero Midstream with terms to expire at the 2025 Annual Meeting of Stockholders, barring an earlier resignation or removal:

|

|

||

| Paul M. Rady | David H. Keyte | ||

Biographical information for the nominees is contained in “Directors” and “Executive Officers” below.

The Board has no reason to believe that any of its nominees will be unable or unwilling to serve if elected. If a nominee becomes unable or unwilling to accept nomination or election, either the size of the Board will be reduced or the individuals acting under your proxy will vote for the election of a substitute nominee recommended by the Board.

|

THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE FOR THE ELECTION OF EACH OF THE DIRECTOR NOMINEES. |

|

- 2022 Proxy Statement 13 |

Summary of Director Qualifications and Experience

We recognize the importance of diversity on our Board. Pursuant to our Diversity and Inclusion Policy and the Nominating and Governance Committee Charter, we view diversity broadly to include diversity of backgrounds, skills and viewpoints as well as traditional diversity concepts such as race, gender, national origin, religion or sexual orientation or identity. The Board believes that all directors should have sound business judgment, personal and professional integrity, an ability to work as part of a team, willingness to commit the required time to serve as a Board member, business experience, and financial literacy. The Nominating & Governance Committee considers diversity along with other factors when reviewing director candidates, and in 2022, we amended our Diversity and Inclusion Policy and our Nominating and Governance Committee Charter to require that each pool of candidates to be considered to fill a vacancy on the Board shall include at least one individual who would be considered diverse based on traditional diversity concepts such as race, gender, national origin, religion, or sexual orientation or identity.

The Board embodied a diverse set of experiences, qualifications, attributes, and skills, as shown below for our directors and director nominees:

| Dea | Keenan | McArdle | Kennedy | Klimley | Mollenkopf | Rady | Keyte | Robeson | |

| Executive Leadership | • | • | • | • | • | • | • | • | • |

| Financial | • | • | • | • | • | • | • | • | |

| Accounting/Audit | • | • | • | • | • | ||||

| Risk Management | • | • | • | • | • | • | • | ||

| Operations | • | • | • | • | • | • | |||

| Industry | • | • | • | • | • | • | • | • | • |

| Environmental and/or Climate Change-Related | • | • | • | • | • | ||||

| Human Resources Management | • | • | • | • | |||||

| Racial/Ethnic Diversity | |||||||||

| Gender Diversity | • | • |

|

- 2022 Proxy Statement 14 |

We were originally formed in 2013 as Antero Resources Midstream Management LLC to become the general partner of Antero Midstream Partners LP. In 2017, Antero Resources Midstream Management LLC converted from a limited liability company to a limited partnership under the laws of the State of Delaware, and changed its name to Antero Midstream GP LP in connection with its initial public offering. In March 2019, Antero Midstream GP LP was converted from a limited partnership to a corporation under the laws of the State of Delaware and changed its name to Antero Midstream Corporation. Other than Messrs. Keyte and Kennedy and Ms. McArdle, who were appointed to the Board in April 2019, April 2021 and March 2020, respectively, each of our existing directors was appointed to the Board in connection with the closing of the simplification transactions (the “Simplification Transactions”) in March 2019.

Set forth below is the background, business experience, attributes, qualifications and skills of each Antero Midstream director and director nominee.

Paul M. Rady and David H. Keyte are up for reelection at the Annual Meeting.

Age: 68 Director Since: Committee Memberships: Compensation Committee, Conflicts Committee |

Peter A. Dea | |

Key Skills, Attributes and Qualifications:

• Co-Founder and Executive Chairman of Confluence Resources LP, since the company’s inception in September 2016 • Co-Founder, President and CEO of Cirque Resources LP since its inception in May 2007 • President, CEO and Director of Western Gas Resources, Inc. from 2001 through their merger with Anadarko Petroleum Corporation in 2006 • CEO and Chairman of the Board of Barrett Resources Corporation from 1999 and 2000, respectively, until its sale in 2001 to Williams Companies • Served as a director of the general partner of Antero Midstream GP LP from April 2018 through the closing of the Simplification Transactions

Has more than 36 years of oil and gas exploration and production experience and involvement in national and state energy policies

Other Public Company Boards:

• Ovintiv Corporation; Liberty Oilfield Services |

|

- 2022 Proxy Statement 15 |

Age: 71 Director Since: Committee Memberships: Compensation Committee, Nominating & Governance Committee

|

W. Howard Keenan, Jr. | |

Key Skills, Attributes and Qualifications:

• Since 1997, has been a Member of Yorktown Partners LLC, a private investment manager focused on the energy industry • From 1975 to 1997, was in the Corporate Finance Department of Dillon, Read & Co. Inc. and active in the private equity and energy areas, including the founding of the first Yorktown Partners fund in 1991 • Serves on the boards of directors of multiple Yorktown Partners portfolio companies • Serves on the Board of Directors of Antero Resources • Served as a director of the general partner of Antero Midstream GP LP beginning in April 2017 and as a director of the general partner of Antero Midstream Partners LP beginning in February 2014, in each case, through the closing of the Simplification Transactions Has over 40 years of experience with energy companies and investments and broad knowledge of the oil and gas industry.

Other Public Company Boards:

• Solaris Oilfield Infrastructure, Inc.; Aris Water Solutions; Antero Resources; Brigham Minerals, Inc. (until January 2022); Ramaco Resources, Inc. (until June 2019); Concho Resources (until 2013); Geomet Inc. (until 2012) |

Age: 61 Director Since: Committee Memberships: Audit Committee, Environmental, Social and Governance (ESG) Committee |

Janine J. McArdle | |

Key Skills, Attributes and Qualifications:

• Founder and Chief Executive Officer of Apex Strategies, LLC, a global consultancy company providing advisory services to midstream and downstream energy companies, since 2016 • Executive of Apache Corporation from 2002 to 2015 serving most recently as Senior Vice President – Gas Monetization • Served as President and Managing Director for Aquila Europe Ltd. from 2001 to 2002 and served in various executive and trading roles prior thereto Has over 30 years of experience as an executive in the oil and gas industry with extensive background in engineering, marketing, business development, finance and risk management.

Other Public Company Boards:

• Santos Ltd;

Halcon Resources Corporation (until 2019) |

|

- 2022 Proxy Statement 16 |

Age: 47 Director Since: 2021 Committee Memberships: Environmental, Social and Governance (ESG) Committee |

Michael N. Kennedy | |

Key Skills, Attributes and Qualifications:

• Currently serves as Senior Vice President—Finance of Antero Midstream and Chief Financial Officer and Senior Vice President—Finance of Antero Resources Corporation • Served as Chief Financial Officer of Antero Midstream from the closing of the Simplification Transactions in March 2019 until April 30, 2021, prior to which Mr. Kennedy served as Chief Financial Officer and Senior Vice President of Finance of the general partner of Antero Midstream GP LP beginning in April 2017 and as Chief Financial Officer and Senior Vice President of Finance of the general partner of Antero Midstream Partners LP beginning in February 2014 • Served as Antero Resources’ Senior Vice President of Finance beginning in January 2016, prior to which he served as Vice President of Finance beginning in August 2013 • Served as Executive Vice President and Chief Financial Officer of Forest Oil Corporation from 2009 to 2013 and served in various financial positions prior thereto • Served as an auditor with Arthur Andersen, focusing on the Natural Resources industry Has significant experience as Former Chief Financial Officer and current Senior Vice President of Finance of Antero Midstream, together with his broad knowledge and experience in the industry.

Other Public Company Boards:

• N/A |

Age: 65 Director Since: Committee Memberships: Nominating & Governance Committee (chair), Environmental, Social and Governance (ESG) Committee (chair), Audit Committee |

Brooks J. Klimley | |

Key Skills, Attributes and Qualifications:

• President of Brooks J. Klimley & Associates, an energy advisory services firm focused on corporate strategy, governance and finance for public and private energy, power and infrastructure companies • Adjunct Professor of Finance and Economics at Columbia University’s School of International and Public Affairs teaching “Energy and Power Financing Markets: The Quest for Sustainable Development” • From 2013 to 2019, served as Managing Director and Head of Energy & Natural Resources at The Silverfern Group • Over 30 years of experience leading investment banking and private equity practices focused on the energy and natural resources sectors • Served as a director of the general partner of Antero Midstream GP LP beginning in 2017, and as a director of the general partner of Antero Midstream Partners LP from March 2015 to 2017, in each case, through the closing of the Simplification Transactions Has significant experience in the public and private upstream and midstream oil and gas industry.

Other Public Company Boards:

• N/A |

|

- 2022 Proxy Statement 17 |

Age: 60 Director Since: Committee Memberships: Audit Committee, Environmental, Social and Governance (ESG) Committee |

John C. Mollenkopf | |

Key Skills, Attributes and Qualifications:

• Prior to his retirement in 2016, served as Executive Vice President and Chief Operating Officer for MarkWest operations of MPLX GP LLC • In 2002, was one of five founders of MarkWest Energy Partners, L.P., and until 2015, served as Executive Vice President and Chief Operating Officer • From 1996 to 2002, worked in various senior management roles for MarkWest Hydrocarbon, Inc. • From 1982 to 1996, worked for ARCO Oil and Gas Company in various roles in engineering and operations • Served as a director of the general partner of Antero Midstream GP LP beginning in April 2017 through the closing of the Simplification Transactions Has significant experience in executive management, business development, marketing, engineering and operations in the oil and gas industry.

Other Public Company Boards:

• N/A |

Age: 68 Director Since: Chairman, Chief Executive Officer and President Committee Memberships: None

|

Paul M. Rady | |

Key Skills, Attributes and Qualifications:

• Currently serves as Chairman, Chief Executive Officer and President of Antero Midstream and Antero Resources • Served as Chief Executive Officer and Chairman of Antero Midstream since the closing of the Simplification Transactions, prior to which Mr. Rady served as (i) Chief Executive Officer of the general partner of Antero Midstream GP LP beginning in January 2017; (ii) as Chairman of the board of directors of such entity beginning in April 2017; and (iii) as Chief Executive Officer and Chairman of the board of directors of the general partner of Antero Midstream Partners LP beginning in February 2014 • Co-founder of Antero Resources Corporation, serving as Chairman of the Board of Directors and Chief Executive Officer of Antero Resources since May 2004 • Served as Chief Executive Officer and Chairman of Antero Resources Corporation’s predecessor company from its founding in 2002 to its ultimate sale to XTO Energy, Inc. in 2005 • Served as President, CEO and Chairman of Pennaco Energy from 1998 until its sale to Marathon in 2001 • Worked with Barrett Resources Corporation from 1990 until 1998, moving from Chief Geologist; to Exploration Manager; EVP Exploration; President, COO and Director; and ultimately CEO • Began his career with Amoco Corporation, where he served ten years as a geologist focused on the Rockies and Mid-Continent Has significant experience as a chief executive of oil and gas companies, together with his training as a geologist and broad industry knowledge.

Other Public Company Boards:

• Antero Resources |

|

- 2022 Proxy Statement 18 |

Age: 66 Director Since: Committee Memberships: Compensation Committee (chair), Conflicts Committee (chair), Nominating & Governance Committee |

David H. Keyte (Lead Director) | |

Key Skills, Attributes and Qualifications:

• Co-founder, Chairman and Chief Executive Officer of Caerus Oil and Gas LLC since 2009 • Former executive of Forest Oil Corporation Has significant experience in executive management and finance in the oil and gas industry.

Other Public Company Boards:

• Regal Entertainment

Group (until 2018) |

Age: 61 Director Since: 2019 Committee Memberships: Audit Committee (chair), Nominating & Governance Committee, Conflicts Committee |

Rose M. Robeson | |

Key Skills, Attributes and Qualifications:

• From 2012 to 2014, served as Senior Vice President & Chief Financial Officer of DCP Midstream GP, LLC • Previously served as Group Vice President and Chief Financial Officer of DCP Midstream LLC from 2002 to 2012 • Served as a director of the general partner of Antero Midstream GP LP beginning in 2017 through the closing of the Simplification Transactions Has more than 30 years of experience in the oil and gas industry, including exploration and production, midstream and marketing. Has significant financial management, risk management and accounting oversight experience.

Other Public Company Boards:

• SM Energy

Company; Newpark Resources Inc.; The Williams Companies; Tesco Corporation (until 2017); American Midstream Partners LP

(until 2016) |

|

- 2022 Proxy Statement 19 |

The table below sets forth the name, age and principal position of each of our executive officers as of December 31, 2021. On December 31, 2021, Alvyn A. Schopp stepped down from his positions as Chief Administrative Officer of Antero Midstream and Antero Resources. Mr. Schopp continues to serve the companies in a non-executive officer role as Regional Senior Vice President of each company. On January 1, 2022, Yvette K. Schultz assumed a portion of the responsibilities relinquished by Mr. Schopp and became an executive officer, to serve as Chief Compliance Officer, Senior Vice President—Legal, General Counsel and Secretary of Antero Midstream and Antero Resources.

| Name | Age | Principal Position |

| Paul M. Rady | 68 | Chairman of the Board, Chief Executive Officer and President |

| Brendan E. Krueger | 37 | Chief Financial Officer, Vice President – Finance and Treasurer |

| Alvyn A. Schopp | 63 | Chief Administrative Officer and Regional Senior Vice President |

| Michael N. Kennedy | 47 | Director and Senior Vice President—Finance |

| W. Patrick Ash | 43 | Senior Vice President—Reserves, Planning and Midstream |

Biographical information for Messrs. Rady and Kennedy is set forth under “Directors” above. References to a position held by one of the below officers at “Antero” means that the person held such position at Antero Resources Corporation, Antero Midstream, the general partner of Antero Midstream GP LP, and the general partner of Antero Midstream Partners LP, as applicable.

Brendan E. Krueger has served as Antero Midstream’s Chief Financial Officer since April 2021. Mr. Krueger has also served as Antero’s Vice President – Finance since April 2018. In addition to his current role, he has served as Antero’s Treasurer since December 2019. Mr. Krueger previously served as Antero’s Finance Director from 2016 to 2018 and Antero’s Finance Manager from 2014 to 2016. Prior to joining Antero, Mr. Krueger spent seven years as an investment banker focused on equity and debt financing and mergers and acquisition advisory with Robert W. Baird & Co., Wells Fargo Securities, and A.G. Edwards, Inc. from 2007 through 2014. Mr. Krueger earned his Bachelor of Business Administration in finance from the University of Notre Dame.

Alvyn A. Schopp currently serves as Antero’s Regional Senior Vice President, prior to which he served as Antero’s Chief Administrative Officer and Regional Senior Vice President beginning in January 2020, prior to which he served as Antero’s Chief Administrative Officer, Regional Senior Vice President and Treasurer beginning in February 2014. Mr. Schopp has also served as Antero’s Vice President of Accounting and Administration and Treasurer from January 2005 to September 2013, as Antero’s Controller and Treasurer from 2003 to 2005 and as Vice President of Accounting and Administration and Treasurer of Antero’s predecessor company from January 2005 until its sale to XTO Energy, Inc. in April 2005. From 1993 to 2000, Mr. Schopp was CFO, Director and ultimately CEO of T-Netix, Inc. From 1980 to 1993 Mr. Schopp was with KPMG. As a Senior Manager with KPMG, he maintained an extensive energy and mining practice. Mr. Schopp holds a B.B.A. from Drake University.

W. Patrick Ash has served as Antero’s Senior Vice President – Reserves, Planning & Midstream, since June 2019, prior to which he served as Vice President of Reservoir Engineering and Planning beginning in December 2017. Prior to joining us, Mr. Ash was at Ultra Petroleum Corp. (“Ultra”) for six years in management positions of increasing responsibility, most recently serving as Vice President, Development, including during and after Ultra’s bankruptcy proceedings in 2016, from which it emerged in 2017. In this position he led the reservoir engineering, geoscience, and corporate engineering groups. From 2001 to 2011, Mr. Ash served in engineering roles at Devon Energy Corporation, NFR Energy LLC and Encana Corporation. Mr. Ash holds a B.S. in Petroleum Engineering from Texas A&M University and a M.B.A. from Washington University in St. Louis.

|

- 2022 Proxy Statement 20 |

Antero Midstream’s sound governance practices and policies provide an important framework to assist the Board in fulfilling its duties to stockholders. The Corporate Governance Guidelines include provisions concerning the following:

| • | qualifications, independence, responsibilities, tenure, and compensation of directors; |

| • | background (including skills, experience and viewpoint) and diversity (including race, gender, national origin, religion, and sexual orientation or identity) of directors, pursuant to Antero’s Diversity and Inclusion Policy; |

| • | service on other boards; |

| • | director resignation process; |

| • | role of the Chairman of the Board and the Lead Director; |

| • | meetings of the Board and of the independent directors; |

| • | interaction between the Board and outside parties; |

| • | annual performance reviews of the Board; |

| • | director orientation and continuing education; |

| • | attendance at meetings of the Board and the Annual Meeting; |

| • | stockholder communications with directors; |

| • | committee functions, committee charters, and independence; |

| • | director access to independent advisors and management; and |

| • | management evaluation and succession planning. |

The Corporate Governance Guidelines are available on Antero Midstream’s website at www.anteromidstream.com in the “Governance” subsection of the “Investors” section. The Nominating & Governance Committee reviews the Corporate Governance Guidelines periodically and as necessary, and any proposed additions or amendments are presented to the Board for its approval.

Rather than adopting categorical standards, the Board assesses director independence on a case-by-case basis, in each case consistent with applicable legal requirements and the listing standards of the New York Stock Exchange (NYSE). After reviewing all relationships each director has with Antero Midstream, including the nature and extent of any business relationships, as well as any significant charitable contributions Antero Midstream makes to organizations where directors serve as board members or executive officers, the Board has affirmatively determined that none of the directors have material relationships with Antero Midstream and all of them are independent as defined by NYSE listing standards except Mr. Rady, Antero Midstream’s Chief Executive Officer and President, and Mr. Kennedy, Antero Midstream’s Senior Vice President of Finance.

|

7 of 9

Directors are Independent

|

|

- 2022 Proxy Statement 21 |

Antero Midstream does not have a formal policy addressing whether the roles of Chairman of the Board and Chief Executive Officer should be separate or combined. The directors serving on the Board have considerable professional and industry experience, significant experience as directors of both public and private companies, and a unique understanding of the challenges and opportunities Antero Midstream faces. Accordingly, the Board believes it is in the best position to evaluate Antero Midstream’s needs and to determine how best to organize its leadership structure to meet those needs at any given time.

At present, the Board has chosen to combine the positions of Chairman and Chief Executive Officer. The Board believes the current Chief Executive Officer is the individual with the necessary experience, commitment, and support of the other members of the Board to effectively carry out the role of Chairman. Mr. Rady brings valuable insight to the Board due to the perspective and experience he has gained as our Chief Executive Officer and as one of our founders. As the principal executive officer since our inception, Mr. Rady has unparalleled knowledge of our business and operations. As a significant stockholder, Mr. Rady is invested in our long-term success. In addition, the Board believes that combining the roles of Chairman and Chief Executive Officer at the present time promotes strong alignment of strategic development and execution, effective implementation of strategic initiatives, and clear accountability for Antero Midstream’s success. Because seven of the nine directors are independent under NYSE rules, the Board believes this leadership structure does not impede independent oversight of Antero Midstream.

The Nominating & Governance Committee reviews this leadership structure every year. Subject to the terms of the Stockholders’ Agreement, the Board believes it is important to retain the flexibility to determine whether the roles of Chairman and Chief Executive Officer should be separated or combined.

To facilitate candid discussion among Antero Midstream’s directors, the non-management directors meet regularly in executive sessions.

The Corporate Governance Guidelines permit the Board, on the recommendation of the Nominating & Governance Committee, to choose a Lead Director to preside at these executive sessions. Mr. Keyte has served in this role since 2019, chairing executive sessions of the non-management directors and establishing the agenda for these meetings. As the Lead Director, Mr. Keyte joins the Chairman in providing leadership and guidance to the Board.

Renominating Incumbent Directors

Subject to the terms of the Stockholders’ Agreement, before recommending to the Board that an existing director be nominated for reelection at the annual meeting of stockholders, the Nominating & Governance Committee will review and consider the director’s:

| • | past Board and committee meeting attendance and performance; |

| • | length of Board service; |

| • | personal and professional integrity, including commitment to Antero Midstream’s core values; |

| • | relevant experience, skills, qualifications and contributions to the Board; and |

| • | independence under applicable standards. |

The Nominating & Governance Committee is responsible for assessing the appropriate balance of skills and characteristics required of Board members.

|

- 2022 Proxy Statement 22 |

Appointing New Directors and Filling Vacancies

The Board believes that all directors should have sound business judgment, personal and professional integrity, an ability to work as part of a team, willingness to commit the required time to serve as a Board member, business experience, and financial literacy. The Nominating & Governance Committee considers diversity along with other factors when reviewing director candidates.

For information regarding the experiences, qualifications, attributes, and skills of the current members of our Board, please see “Proxy Summary—Summary of Director Qualifications and Experience.”

The Nominating & Governance Committee will treat informal recommendations for directors that are received from Antero Midstream’s stockholders in the same manner as recommendations received from any other source. The Nominating & Governance Committee and the Board will also consider the benefits of all aspects of diversity, and will consider whether, and if so how, to identify new candidates for Board service and when identifying potential new Board members or filing a vacancy on the Board, commits to seeking out diverse candidates to the extent possible. In 2022, we amended our Diversity and Inclusion Policy and our Nominating and Governance Committee Charter to require that each pool of candidates to be considered to fill a vacancy on the Board shall include at least one individual who would be considered diverse based on traditional diversity concepts such as race, gender, national origin, religion, or sexual orientation or identity.

|

- 2022 Proxy Statement 23 |

In the normal course of its business, Antero Midstream is exposed to a variety of risks, including its ability to execute its business strategy, competition, governmental regulations, interest rate risks, and credit and investment risk, as well as risks relating to Antero Resources’ ability to meet its drilling and development plan. At least annually, our Board receives updates from management regarding information security, cyber security and data security risks in connection with Antero Midstream’s Enterprise Risk Management program. The Board and each committee has distinct responsibilities for monitoring other risks, as shown below.

| The Board of Directors | ||||

| The Board oversees Antero Midstream’s strategic direction. To that end, the Board considers the potential rewards and risks of Antero Midstream’s business opportunities and challenges, and it monitors the development and management of risks that impact our strategic goals. | ||||

Audit Committee

The Audit Committee monitors the effectiveness of Antero Midstream’s systems of financial reporting, auditing and internal controls, as well as related legal and regulatory compliance matters.

|

Nominating & Governance Committee

The Nominating & Governance Committee oversees the management of risks associated with Board organization, membership and structure; succession planning for our directors and executive officers; and corporate governance.

|

Compensation Committee

The Compensation Committee oversees Antero Midstream’s compensation policies and practices.

|

Environmental, Social and Governance (ESG) Committee

The Environmental, Social and Governance (ESG) Committee provides guidance to the Board on, and oversees Antero Midstream’s risk management policies related to, corporate citizenship, environmental sustainability, and social and political trends, issues and concerns. The ESG Committee regularly receives reports from management on pertinent ESG risks or opportunities, including climate related topics.

|

Conflicts Committee

The Conflicts Committee assists the Board in investigating, reviewing and evaluating potential conflicts of interest, including those between Antero Midstream and Antero Resources. |

The Board believes that a robust and constructive evaluation process is an essential component of Board effectiveness and good corporate governance. To that end, the Board and each of its standing committees conducts an annual self-assessment to evaluate their performance, composition, and effectiveness, and to identify areas for improvement.

These evaluations take the form of wide-ranging and candid discussions. The Lead Director facilitates discussions evaluating the full Board, and the committee chairs facilitate discussions regarding their respective committees.

|

- 2022 Proxy Statement 24 |

Directors are elected by a plurality of votes cast in an uncontested election. The Corporate Governance Guidelines require that an incumbent director who fails to receive the required number of votes for reelection must tender a resignation. The Nominating & Governance Committee will act on an expedited basis to determine whether to accept any such resignation, and will submit its recommendation for prompt consideration by the Board. The Board expects the director whose resignation is under consideration to abstain from participating in this decision. The Nominating & Governance Committee and the Board may consider any factors they deem relevant in deciding whether to accept a director’s resignation.

The Board held twelve meetings in 2021. The then-serving outside directors held four executive sessions. No director attended fewer than 75% of the meetings of the Board and of the committees of the Board on which that director served during the respective time he or she served, except Mr. Dea who attended 71% of such meetings.

Directors are encouraged to attend the Annual Meetings of Stockholders. All of the then-serving members of the Board attended the 2021 Annual Meeting.

General Communications

Stockholders and other interested parties may communicate with us by writing to Antero Midstream Corporation, 1615 Wynkoop Street, Denver, Colorado 80202. Stockholders may submit their thoughts to the Board, any committee of the Board, or individual directors on a confidential or anonymous basis by sending the communication in a sealed envelope marked “Stockholder Communication with Directors” and clearly identifying the intended recipient(s).

Antero Midstream’s Chief Compliance Officer and Secretary will review and forward each communication, as soon as reasonably practicable, to the addressee(s) if the communication falls within the scope of matters generally considered by the Board. To the extent the subject matter of a communication is appropriate and relates to matters that have been delegated by the Board to a committee other than the addressee(s) or to an executive officer, the Chief Compliance Officer and Secretary also may forward the communication to the applicable officer or committee chair.

Legal or Compliance Concerns

Information regarding legal or compliance concerns may be submitted confidentially and anonymously, although Antero Midstream may be obligated by law to disclose the information or identity of the person providing the information in connection with government or private legal actions and in other circumstances. Antero Midstream’s policy is not to take any adverse action, and not to tolerate any retaliation, against any person for asking questions or making good faith reports of possible violations of law, Antero Midstream’s policies or our Corporate Code of Business Conduct and Ethics.

|

- 2022 Proxy Statement 25 |

Insider Trading Policy

Antero Midstream’s Insider Trading Policy, which applies to all employees, officers, and directors, prohibits hedging of Antero Midstream securities and engaging in any other transactions involving Antero Midstream-based derivative securities, regardless of whether the covered person is in possession of material, non-public information. The policy does not affect the vesting of securities acquired pursuant to Antero Midstream’s incentive, retirement, stock purchase, or dividend reinvestment plans, or other transactions involving purchases and sales of company securities between a covered person and Antero Midstream. Antero Midstream’s Insider Trading Policy also prohibits purchasing Antero Midstream common stock, par value $0.01 per share (“Antero Midstream Common Stock”), on margin (e.g., borrowing money to fund the stock purchase) and pledging Antero Midstream securities.

The following materials are available on Antero Midstream’s website at www.anteromidstream.com under “Investors” and then “Governance—Governance Documents.”

| • | Certificate of Incorporation of Antero Midstream |

| • | Bylaws of Antero Midstream |

| • | Charters of the Audit Committee, the Compensation Committee, the Nominating & Governance Committee, and the Environment, Sustainability and Social Governance Committee; |

| • | Corporate Code of Business Conduct and Ethics; |

| • | Financial Code of Ethics; |

| • | Corporate Governance Guidelines; |

| • | Human, Labor and Indigenous Rights Policy; |

| • | Diversity and Inclusion Policy; |

| • | Supplier Code of Conduct; |

| • | Whistleblower Policy; and |

| • | Political Advocacy Policy. |

Stockholders may obtain a copy, free of charge, of any of these documents by sending a written request to Antero Midstream Corporation, 1615 Wynkoop Street, Denver, Colorado, 80202. Any amendments to Antero Midstream’s Corporate Code of Business Conduct and Ethics will be posted in the “Governance” subsection of our website.

The Board had five standing committees in 2021: the Audit Committee, the Compensation Committee, the Nominating & Governance Committee, the Conflicts Committee and the Environmental, Social and Governance (ESG) Committee. The charters of the Audit Committee, Compensation Committee, Nominating & Governance Committee and Environmental, Social and Governance (ESG) Committee are available on Antero Midstream’s website at www.anteromidstream.com in the “Governance—Governance Documents” subsection of the “Investors” section.

The Board creates ad hoc committees on an as-needed basis. There were no ad hoc committees in 2021.

|

- 2022 Proxy Statement 26 |

| * | Immediately prior to the Annual Meeting, Mr. Keyte is expected to join the Audit Committee as its chair. |

| ** | Janine J. McArdle joined the Audit Committee on September 17, 2021. |

| * | Peter A. Dea joined the Compensation Committee, and Janine J. McArdle stepped down from the Compensation Committee, on September 17, 2021. |

|

- 2022 Proxy Statement 27 |

| * | W. Howard Keenan, Jr. joined the Nominating & Governance Committee on September 17, 2021. |

| * | Michael N. Kennedy joined the Environmental, Social and Governance (ESG) Committee on September 17, 2021. |

|

- 2022 Proxy Statement 28 |

Our non-employee directors are entitled to receive compensation consisting of retainers, fees and equity awards as described below. The Compensation Committee reviews non-employee director compensation periodically and recommends changes, if appropriate, to the Board for approval.

Our employee directors do not receive additional compensation for their services as directors. All compensation received from Antero Midstream as employees is disclosed in the Summary Compensation Table on page 50.

Effective April 15, 2021, some of the annual retainers payable to non-employee directors of the Board were increased slightly, as indicated below. These modifications were made to ensure that our director compensation is competitive with that paid by our peers so that we can attract and retain qualified individuals to serve on our Board.

| Recipient | Amount | |||

| Non-employee director | $ | 90,000 | ||

| Lead Director | $ | 25,000 | ||

| Audit Committee: | ||||

| Chairperson | $ | 24,000 (previously $20,000) | ||

| Other members | $ | 15,000 (previously $7,500) | ||

| Compensation, Nominating & Governance, and ESG Committees: | ||||

| Chairperson | $ | 15,000 | ||

| Other members | $ | 7,500 (previously $5,000) | ||

| Conflicts Committee: | ||||

| Chairperson | $ | 7,500 (previously $5,000) | ||

| Other members | $ | 7,500 (previously $5,000) | ||

All retainers are paid in cash on a quarterly basis in arrears, but directors have the option to elect, on an annual basis, to receive all or a portion of their cash retainers in the form of shares of our common stock.

Effective April 15, 2022, the annual retainer for non-employee directors will be increased from $90,000 to $97,500. Otherwise, the compensation for our non-employee directors will be the same in 2022 as that described for 2021.

|

- 2022 Proxy Statement 29 |

In addition to cash compensation, our non-employee directors receive annual equity-based compensation consisting of fully-vested stock with an aggregate grant date value equal to $130,000, subject to the terms and conditions of the Antero Midstream Corporation Long Term Incentive Plan (“AM LTIP”) and the agreements pursuant to which such awards are granted. These awards are granted in arrears on a quarterly basis, so each installment has a grant date fair value of approximately $32,500.

For 2021, the directors who are members of Board committees were eligible to receive a fee of $1,500 for each committee meeting attended in excess of ten meetings for such committee per calendar year (up to a maximum of $22,500 per committee). Directors are also reimbursed for reasonable expenses incurred to attend meetings and activities of the Board or its committees, and to attend and participate in general education and orientation programs for directors.

Under our stock ownership guidelines, within five years of being elected or appointed to the Board or five years from the adoption of the policy, whichever is later, a non-employee director, other than Mr. Keenan, is required to own shares of our common stock with a fair market value equal to at least five times the amount of the annual cash retainer. These stock ownership guidelines are designed to align our directors’ interests more closely with those of our stockholders. The guidelines were adopted less than five years from the measurement date in 2021. As a result, each of our non-employee directors still has additional time remaining to achieve compliance with the stock ownership guidelines. For information regarding stock ownership guidelines applicable to our executive officers, please see “Compensation Discussion and Analysis—Other Matters—Stock Ownership Guidelines.”

The following table provides information concerning the compensation of our non-employee directors for the fiscal year ended December 31, 2021.

| Name | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2) | Total ($) | |||||||||

| Peter A. Dea | 100,625 | 129,983 | 230,608 | |||||||||

| W. Howard Keenan, Jr. | 100,625 | 129,983 | 230,608 | |||||||||

| David H. Keyte | 143,750 | 129,983 | 273,733 | |||||||||

| Brooks J. Klimley | 133,125 | 129,983 | 263,108 | |||||||||

| John C. Mollenkopf | 110,000 | 129,983 | 239,983 | |||||||||

| Janine J. McArdle | 107,500 | 129,983 | 237,483 | |||||||||

| Rose M. Robeson | 126,750 | 129,983 | 256,733 | |||||||||

| (1) | Includes annual cash retainer, committee fees, committee chair fees and meeting fees earned during fiscal 2021. |

| (2) | Amounts in this column reflect the aggregate grant date fair value of shares granted under the AM LTIP to each non-employee director during fiscal year 2021, computed in accordance with the rules of Financial Accounting Standards Board Accounting Standards Codification Topic 718 (“FASB ASC Topic 718”). See Note 12 to our consolidated financial statements on Form 10-K for the year ended December 31, 2021, for additional detail regarding assumptions underlying the value of these equity awards. |

|

- 2022 Proxy Statement 30 |

The Audit Committee of the Board has selected KPMG LLP as Antero Midstream’s independent registered public accounting firm for the year ending December 31, 2022. KPMG LLP has audited Antero Midstream’s and its predecessor’s financial statements since 2016 as well as the financial statements of Antero Midstream Partners LP since 2013. The Audit Committee annually evaluates the accounting firm’s qualifications to continue to serve Antero Midstream. In evaluating the accounting firm, the Audit Committee considers the reputation of the firm and the local office, the industry experience of the engagement partner and the engagement team, and the experience of the engagement team with clients of similar size, scope and complexity as Antero Midstream. The Audit Committee is directly involved in the selection of the new engagement partner when rotation is required every five years in accordance with SEC rules. KPMG LLP completed the audit of Antero Midstream’s annual consolidated financial statements for the year ended December 31, 2021, on February 16, 2022.

The Board is submitting the selection of KPMG LLP for ratification at the Annual Meeting. The submission of this matter for ratification by stockholders is not legally required, but the Board and the Audit Committee believe the ratification proposal provides an opportunity for stockholders to communicate their views about an important aspect of corporate governance. If our stockholders do not ratify the selection of KPMG LLP, the Audit Committee will reconsider, but will not be required to rescind, the selection of that firm as Antero Midstream’s independent registered public accounting firm.

Representatives of KPMG LLP are expected to be present at the Annual Meeting. They will have the opportunity to make a statement, and are expected to be available to respond to appropriate questions.

The Audit Committee has the authority and responsibility to retain, evaluate and replace Antero Midstream’s independent registered public accounting firm. Stockholder ratification of the appointment of KPMG LLP does not limit the authority of the Audit Committee to change Antero Midstream’s independent registered public accounting firm at any time.

|

THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE FOR THE RATIFICATION OF THE SELECTION OF KPMG LLP AS ANTERO MIDSTREAM’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDING DECEMBER 31, 2022. |

|

- 2022 Proxy Statement 31 |