UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a)

of the Securities

Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant |  |

Filed by a Party other than the Registrant |

| Check the appropriate box: | |

|

Preliminary Proxy Statement |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | |

|

No fee required |

|

Fee paid previously with preliminary materials |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

JUNE 5, 2024 8:00 A.M. Mountain Time

Antero Principal Executive Offices 1615 Wynkoop Street |

|

NOTICEof

2024 Annual Meeting |

The 2024 Annual Meeting of Stockholders of Antero Midstream Corporation (“Antero Midstream”) will be held online on Wednesday, June 5, 2024, at 8:00 A.M. Mountain Time. The Annual Meeting is being held for the purposes listed below:

AGENDA

| 1. | Elect the three Class II members of Antero Midstream Corporation’s Board of Directors (the “Board”) named in this Proxy Statement to serve until Antero Midstream’s 2027 Annual Meeting of Stockholders, |

| 2. | Ratify the appointment of KPMG LLP as Antero Midstream’s independent registered public accounting firm for the year ending December 31, 2024, |

| 3. | Approve, on an advisory basis, the compensation of Antero Midstream’s named executive officers, |

| 4. | Approve the Amended and Restated Antero Midstream Corporation Long Term Incentive Plan, and |

| 5. | Transact other such business as may properly come before the meeting and any adjournment or postponement thereof. |

These proposals are described in the accompanying proxy materials.

RECORD DATE

April 15, 2024

By order of the Board of Directors,

Yvette K. Schultz

Chief Compliance Officer, Senior Vice President—Legal, General Counsel and Corporate Secretary

WHO MAY VOTE:

You will be able to vote at the Annual Meeting only if you were a stockholder of record at the close of business on April 15, 2024, the record date for the Annual Meeting. The Board requests your proxy for the Annual Meeting, which will authorize the individuals named in the proxy to represent you and vote your shares at the Annual Meeting or any adjournment or postponement thereof.

HOW TO RECEIVE ELECTRONIC DELIVERY OF FUTURE ANNUAL MEETING MATERIALS:

Pursuant to rules adopted by the Securities and Exchange Commission, we have elected to provide access to our proxy solicitation materials electronically, rather than mailing paper copies of these materials to each stockholder. Beginning on April 25, 2024, we will mail to each stockholder a Notice of Internet Availability of Proxy Materials with instructions on how to access the proxy materials, vote, or request paper copies.

IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 5, 2024:

This Notice of Annual Meeting and Proxy Statement and the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 (the “Form 10-K”) are available on our website free of charge at www.anteroresources.com in the “SEC Filings” subsection of the “Investors” section.

YOUR VOTE IS IMPORTANT

Your vote is important. We urge you to review the accompanying Proxy Statement carefully and to submit your proxy as soon as possible so that your shares will be represented at the meeting.

| REVIEW YOUR PROXY STATEMENT AND VOTE IN ONE OF FOUR WAYS: |  |

|

|

| ||||

| If you are a registered stockholder as of the record date, you may vote your shares or submit a proxy to have your shares voted by one of the following methods: | INTERNET Use the website listed on the Notice of Internet Availability (the “Notice”) |

BY TELEPHONE Use the toll-free number listed on the Notice |

BY MAIL Sign, date and return your proxy card in the provided pre-addressed envelope |

DURING THE ANNUAL MEETING Vote online during the Annual Meeting. See page 10 of the Proxy Statement for instructions on how to attend online |

Table of Contents

|

- 2024 Proxy Statement 2 |

|

- 2024 Proxy Statement 3 |

This summary highlights information contained in this Proxy Statement. This proxy summary does not contain all of the information you should consider, and you should read this entire Proxy Statement before voting.

Some highlights of our ESG and corporate responsibility efforts appear below. Please visit https://www.anteromidstream.com/esg for more information and a link to our most recent ESG report.(1)

The largest contribution in making Antero Midstream a responsible and sustainable company comes from our talented and experienced employees.

| • | The safety and security of our people and the integrity of our operations are our top priorities. Our health and safety compliance program seeks to protect our workforce and the communities in which we operate by striving for “Zero incidents, Zero harm, Zero compromise.” We have sought to implement developed and thoughtful processes for identifying and mitigating safety risks: | |

| – | Identification – behavior-based safety programs, job safety analysis, emergency response drills and contractor vetting through a reputable third-party vendor | |

| – | Mitigation – contractor safety improvement plans, root cause analyses, risk ranking and mitigation reviews, pre-job safety startup reviews, and a library of over 30 individual training courses | |

| • | We believe that our success as a company is not measured only by our financial results but also by how we treat our employees. We seek to help our people enjoy healthier lives, achieve educational goals, and pursue economic opportunities for themselves and their families by offering competitive compensation and benefits, including: | |

| – | Healthcare coverage – medical and prescription, dental and vision | |

| – | Financial assistance – health savings accounts, student loan repayment reimbursement, dependent care flexible spending account coverage and 401(k) plan with matching up to 6% | |

| – | Insurance – basic life, accidental death and disability, short-term disability and long-term disability coverage | |

| – | Lifestyle – employee assistance program, holidays and personal choice days, paid vacation and sick leave, company-paid parental leave, gym membership and/or fitness subscription reimbursement, and free parking and public transportation | |

| • | Doing the right thing is essential to our culture. To that end, we conduct an annual, company-wide ethics and compliance training program that covers, among other things, ethical business practices, insider trading, anti-discrimination and anti-harassment. | |

| • | We aim to respect human rights and promote them in our supply chain through, among other things, our company policies, including: | |

| – | Supplier Code of Conduct – promotes the fair and ethical treatment by suppliers, contractors, independent consultants and other parties that Antero Midstream works with through a set of guidelines focusing on equal opportunity, workplace safety, protection of the environment, among other things | |

| (1) | Please note that this Internet address is for information purposes only, and no information found and/or provided at such Internet address, contained on our website in general, or included in our ESG Report is intended or deemed to be incorporated by reference in this Proxy Statement. |

|

- 2024 Proxy Statement 4 |

| – | Human, Labor and Indigenous Rights Policy –promotes respect of human rights through compliance with applicable national and local laws as well as pertinent trends and norms with respect to compensation, discrimination, health and safety, community and indigenous peoples, and that prohibits child labor, forced labor and human trafficking, as well as workplace harassment, discrimination, and misuse of employer power, in line with applicable laws related to all of these topics; and provides access to a hotline for reporting concerns or grievances |

We are committed to enhancing the communities where we live and work. Recent highlights of our community engagement and investment include:

| • | Together with Antero Resources Corporation (“Antero Resources”): | |

| – | Committed to donate $4.0 million to West Virginia University Benjamin M. Statler College of Engineering and Mineral Resources | |

| – | Contributed meaningful employment opportunities in the Appalachian Region | |

| • | Together with the Antero Foundation and Antero Resources: | |

| – | Donated $1.3 million to philanthropic and community endeavors, including $0.2 million to 57 regional food pantries in West Virginia and Ohio in 2023 | |

| – | Donated $3.8 million to philanthropic and community endeavors over the last five years, including regional food pantries, healthcare providers, homeless outreach and shelter providers, and crisis outreach and shelter services | |

We recognize the importance of supporting and promoting diversity in our workplace. Our Diversity and Inclusion Policy prohibits all forms of unlawful discrimination based on age, race, ethnicity, religion, sex, gender identity and other impermissible factors. In addition, we identify qualifications, attributes, and skills that are important to be represented on the Board. We consider individuals of all backgrounds, skills and viewpoints when seeking employees and candidates for Board service.

As set forth in our Diversity and Inclusion Policy and our Nominating & Governance Committee Charter, we view diversity broadly to include diversity of backgrounds, skills and viewpoints as well as traditional diversity concepts such as race, gender, national origin, religion or sexual orientation or identity. Our Diversity and Inclusion Policy and our Nominating and Governance Committee Charter require that each initial pool of candidates to be considered to fill a vacancy on the Board includes at least one individual who is considered diverse based on the traditional diversity concepts described therein.

We embrace an approach that values diversity, and we are committed to making opportunities for development and progress available to all employees so their talents can be fully developed and our and their success can be maximized. We believe that creating an environment that cultivates a sense of belonging requires encouraging employees to educate themselves about each other’s experiences, and we strive to promote the respect and dignity of all persons. We also believe it is important that we foster education, communication and understanding about diversity, inclusion and belonging. In line with our commitment to equal employment opportunity and diversity and inclusion, our outside recruiters are asked to review our Diversity and Inclusion Policy and implement practices that align with it, including providing us with a diverse initial pool of employee candidates.

|

- 2024 Proxy Statement 5 |

In recent years, we have promoted a number of women to senior management roles, including Chief Compliance Officer, Senior Vice President—Legal, General Counsel and Corporate Secretary, Chief Accounting Officer and Senior Vice President—Accounting, Senior Vice President—Geology and Vice President—Production. In 2023, over one-third of our newly hired employees identified as individuals from a group that has been historically underrepresented.

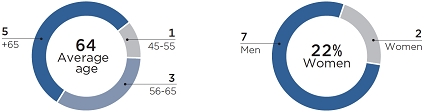

As of December 31, 2023:

| 23% | 29% | 18% | ||

| of our employees are women | of our independent directors are women | of our directors and corporate officers are women | ||

Our Board has ultimate oversight over the company’s operational performance and ethical conduct. This includes, in partnership with our executive leadership team, managing our risk mitigation. Highlights of our corporate, environmental and social governance programs include:

| • | Director independence and Board composition | |

| – | Seven out of nine directors are independent | |

| – | We have an independent lead director | |

| – | Each Board committee is chaired by an independent director and comprised entirely of independent directors (except for the ESG Committee) | |

| – | The ages of our directors range from 49 to 73 years old, and the average director tenure is 3.3 years | |

| • | Focus on Environmental and Social Matters | |

| – | We have an ESG Committee of the Board that guides and governs our ESG initiatives | |

| – | We have an ESG Advisory Council, made up of members of management from across the organization, that develops a centralized, systematic approach for identifying, managing and communicating ESG risks and opportunities | |

| – | 15% of executive target annual incentive compensation is tied to certain ESG performance metrics | |

| – | In 2023, 100% of employees completed training for our Diversity and Inclusion Policy, Human, Labor and Indigenous Rights Policy, our Supplier Code of Conduct, and with respect to unconscious bias | |

| • | Valuing investor feedback and alignment with stockholders | |

| – | We proactively engage with stockholders and other stakeholders, including with respect to ESG programs and performance | |

| – | Our executive compensation program and robust stock ownership guidelines applicable to directors and executives were thoughtfully designed to incentivize the maximization of shareholder value | |

| – | Our corporate policies generally prohibit hedging or pledging company stock | |

We believe safety and environmental stewardship are intrinsically linked. “Zero incidents, Zero harm, Zero compromise” is designed to empower every employee to make the safest decisions to protect our people and be a good steward to the environment. Our dedicated staff of health, safety, security and environmental (“HSSE”) professionals manage our HSSE programs and are committed to our performance as a safe and sustainable energy company. In addition, stewardship of the environment is a fundamental value in our overall business strategy.

|

- 2024 Proxy Statement 6 |

Our Environmental and Safety highlights include:

| • | 2023 environmental and safety performance | |

| – | Scope 1 GHG emissions of 2.0 million metric tons of CO2e, | |

| – | Scope 1 GHG intensity of 1.7 metric tons of CO2e/MMscfe, an 8% reduction from 2022 | |

| – | 89% of wastewater received by Antero Midstream is recycled | |

| – | TRIR and LTIR for our employees and contractors of 0.304 and zero, respectively, in 2023, maintaining our commitment to the safety of our employees and contractors | |

| • | Continued progress towards 100% reduction in pipeline emissions by 2025 and Net Zero Scope 1 (direct) and Scope 2 (indirect from the purchase of energy) emissions by 2050 through the following: | |

| – | Conducted quarterly facility LDAR inspections on all of our compressor stations | |

| – | Conducted three aerial flyovers of nine compressor station locations as part of our emissions monitoring initiative | |

| – | Installed pigging blowdown capture systems at eight locations including six compressor stations and two pipeline interchanges | |

| – | Developed, field tested and submitted patent pending technology that passed proof of concept examination for hydraulic emission displacement designed to eliminate GHG emissions from pipeline maintenance activities | |

| – | Developed a marginal abatement cost curve to effectively and systematically model emission reduction projects across our operations | |

| – | Active participation in the U.S. EPA Natural Gas STAR program, ONE Future, The Environmental Partnership, and the Colorado State University’s Methane Emissions Technology Evaluation Center, which provides us with information and resources to help reduce our GHG emissions. | |

| • | ESG disclosures are aligned with the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-Related Financial Disclosures (TCFD) | |

| • | Management regularly reports to the Board ESG Committee on pertinent ESG risks and opportunities, including climate-related topics | |

In 2019, we significantly enhanced shareholder rights and our corporate governance practices. In March of 2019, equity holders of Antero Midstream Partners LP (“AMLP”) and Antero Midstream GP LP (“AMGP”) approved proposals to combine the two companies and convert the resulting company from a limited partnership into a corporation. The transaction and resulting governance structure was approved by the boards of directors and conflicts committees of both AMLP and AMGP, was recommended by both ISS and Glass Lewis, and was overwhelmingly approved by equity holders of AMLP and AMGP. In connection with the transaction, our shareholders overwhelmingly approved a proposal to convert from a limited partnership to a corporation and adopt a certificate of incorporation that enhanced shareholders’ rights. Approximately 99% of votes cast were in favor of converting from a limited partnership to a corporation and adopting our current certificate of incorporation. While the certificate of incorporation approved by shareholders contains provisions for a classified board of directors and a supermajority vote for certain amendments, at the time ISS recommended shareholders vote for the conversion and adoption of the certificate of incorporation, noting that support for the proposal was warranted in part due to the valuable governance protections and enhanced rights that shareholders would experience.

|

- 2024 Proxy Statement 7 |

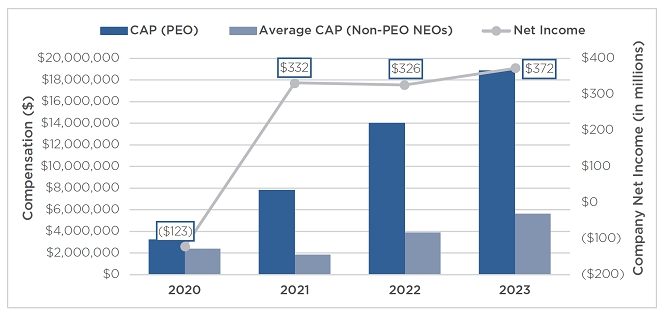

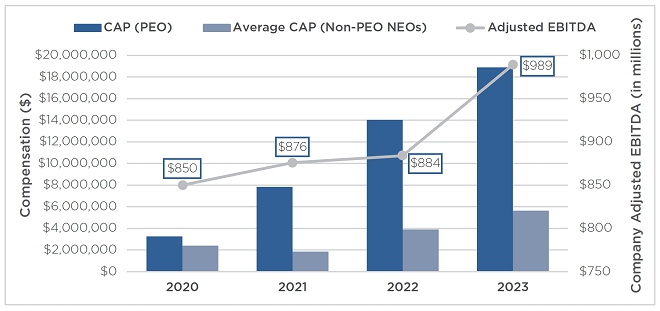

| • | Key 2023 Company performance highlights include: | |

| – | Net income increased by 14% to $372 million | |

| – | Gathering volumes of 3.3 Bcf/d were a company record and represented approximately 3% of U.S. lower 48 natural gas production | |

| – | Delivered asset uptime availability of over 99% and successfully integrated two bolt-on acquisitions | |

| – | Capital expenditures declined by 30% while delivering gathering and compression volumetric growth of 11% and 15%, respectively | |

| – | Generated Free Cash Flow after Dividends that exceeded the initial guidance by over 40% | |

| – | Reduced absolute debt by approximately $150 million | |

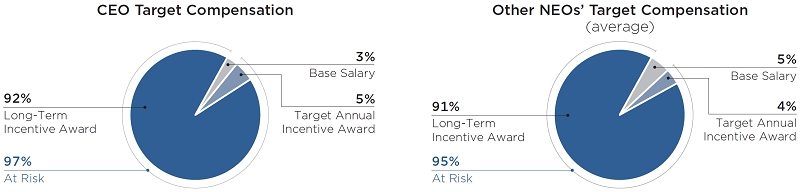

| Below is a summary of key components and decisions of our executive compensation program for 2023: | ||

| • | Long-term incentive compensation awards were 75% time-based equity awards and 25% performance-based equity awards to our Named Executive Officers in March 2023. All long-term incentive awards vest over several years to reward sustained Company performance over time. | |

| • | Executive compensation is in part tied to a qualitative assessment of ESG performance by the Compensation Committee. Our ESG performance is focused on three primary areas: | |

| – | Progress towards 100% reduction in pipeline emissions by 2025 and Net Zero (Scope 1 and 2) emissions by 2050 | |

| – | Water Recycling | |

| – | Total Recordable Incident Rate | |

| • | The annual incentive plan for 2023 included metrics we felt were key to value creation. These included free cash flow after dividends, leverage goals, return on invested capital goals and ESG performance. The annual incentive results of 199.6% reflected the excellent performance of the Company in 2023. The full details of our annual incentive plan metrics, goals and results are shown on page 42 of the proxy. | |

| • | Each of the Named Executive Officers is employed at-will and none of the Named Executive Officers is party to an employment agreement, severance agreement or change in control agreement. | |

Antero Midstream and the Board value input from stockholders, and we are committed to maintaining an open dialogue to receive feedback on important items. In 2023, we met with stockholders to discuss, among other things, compensation and ESG matters.

|

- 2024 Proxy Statement 8 |

| Director | Director | Committee Memberships | ||||||||||||||||||

| Name | Class | Age | Occupation | Since | Independent | Audit | Comp | Nom & Gov | Conflicts | ESG | ||||||||||

| Peter A. Dea | Class I | 70 | Co-Founder and Executive Chairman of Confluence Resources LP | 2019 |  |  |  | |||||||||||||

| W. Howard Keenan, Jr. | Class I | 73 | Member of Yorktown Partners LLC | 2019 |  |  |  | |||||||||||||

| Janine J. McArdle | Class I | 63 | Founder and CEO of Apex Strategies, LLC | 2020 |  |  |  | |||||||||||||

| Michael N. Kennedy | Class II | 49 | SVP – Finance of Antero Midstream | 2021 |  | |||||||||||||||

| Brooks J. Klimley | Class II | 67 | Founder and President of Brooks J. Klimley & Associates | 2019 |  |  |  |  | ||||||||||||

| John C. Mollenkopf | Class II | 62 | Retired Chief Operating Officer of MarkWest operations of MPLX GP LLC | 2019 |  |  |  | |||||||||||||

| Paul M. Rady | Class III | 70 | Chairman of the Board and Antero Midstream Chief Executive Officer | 2019 | ||||||||||||||||

| Nancy E. Chisholm | Class III | 57 | Former President of Tyco Retail Solutions | 2022 |  |  |  | |||||||||||||

| David H. Keyte | Class III | 68 | Chairman and Chief Executive Officer of Caerus Oil and Gas LLC | 2019 |  |  |  |  |  | |||||||||||

|

Chairperson |

Board Composition Highlights

|

- 2024 Proxy Statement 9 |

We are pleased this year to conduct the Annual Meeting solely online via the Internet through a live webcast and online stockholder tools. We are conducting the Annual Meeting virtually because we believe a virtual format makes it easier for stockholders to attend and participate. Moreover, this format empowers stockholders around the world to participate at no cost.

Here are several ways our virtual format will enhance stockholder access and participation and protect stockholder rights:

| • | We Encourage Questions. Stockholders can submit questions for the meeting online in advance or live during the meeting, following the instructions below. During the meeting, we will answer as many appropriate stockholder-submitted questions as time permits. Following the Annual Meeting, we will publish an answer to each appropriate question we received on our Investor Relations website at www.anteromidstream.com/investors as soon as practical. |

| • | We Believe in Transparency. Although the live webcast is available only to stockholders at the time of the meeting, we will post a webcast replay, the final report of the inspector of election, and answers to all appropriate questions asked by stockholders in connection with the Annual Meeting to our Investor Relations website at www.anteromidstream.com/investors. |

| • | We Proactively Take Steps to Facilitate Your Participation. During the Annual Meeting, we will offer live technical support for all stockholders attending the meeting. |

You are entitled to attend and participate in the virtual Annual Meeting only if you were a stockholder as of the close of business on April 15, 2024 or if you hold a valid proxy for the Annual Meeting. If you are not a stockholder, you may still view the meeting after the recording has been posted on our Investor Relations website.

Attending Online. If you plan to attend the Annual Meeting online, please read the instructions below so you understand how to gain admission. If you do not comply with these procedures, you will not be able to participate in the Annual Meeting.

Stockholders may participate in the Annual Meeting by visiting www.virtualshareholdermeeting.com/AM2024. If you are a stockholder of record, you will need the control number on your Notice of Internet Availability (the “Notice”) or proxy card to log in. For beneficial stockholders who do not have a control number, instructions to gain access to the meeting may be provided on the voting instruction card you receive from your broker, bank, or other nominee.

Stockholders of record hold shares directly with Equiniti Trust Company, LLC (formerly American Stock Transfer and Trust Company LLC). “Beneficial” or “street name” stockholders hold shares through a broker, bank, or other nominee.

Please allow ample time to check in to the virtual meeting. The site will be available beginning at 7:45 A.M. Mountain Time. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the Virtual Shareholder Meeting log in page.

Asking Questions. Stockholders who wish to submit a question in advance may do so on our Annual Meeting website, www.virtualshareholdermeeting. com/AM2024, which will be open 15 minutes before the Annual Meeting. Stockholders also may submit questions live during the meeting. We plan to reserve up to 20 minutes for appropriate stockholder questions to be read and answered by Company personnel during the meeting, but we will only address questions that are germane to the matters being voted on at our Annual Meeting. Stockholders can also access copies of this Proxy Statement and annual report at our Annual Meeting website.

|

- 2024 Proxy Statement 10 |

Whether you are a stockholder of record or a beneficial stockholder, you may direct how your shares are voted without participating in the Annual Meeting. We encourage stockholders to vote well before the Annual Meeting, even if they plan to attend. If you are a registered stockholder as of the record date, you may vote your shares or submit a proxy to have your shares voted by one of the following methods:

| • | Online. Submit a proxy electronically using the website listed on the Notice. You will need the control number from your Notice to log on to the website. Internet voting facilities will be available until 11:59 p.m., Eastern Time, on Tuesday, June 4, 2024. |

| • | By Telephone. Request the proxy materials and submit a proxy by telephone using the toll-free number listed on the Notice. You will need the control number from your Notice when you call. Telephone voting facilities will be available until 11:59 p.m., Eastern Time, on Tuesday, June 4, 2024. |

| • | By Mail. You may request a hard copy proxy card by following the instructions on the Notice. You can submit your proxy by signing, dating and returning your proxy card in the provided pre-addressed envelope. |

| • | In Person Online. If you are a registered stockholder and you attend the Annual Meeting online, you can vote via the Internet during the meeting. Follow the instructions at www.virtualshareholdermeeting.com/AM2024 to vote during the meeting. |

If you are a beneficial stockholder, you will receive instructions from the holder of record that you must follow for your shares to be voted. Most banks and brokers offer Internet and telephone voting. If you do not give voting instructions, your broker will not be permitted to vote your shares on any matter that comes before the Annual Meeting except the ratification of our auditors.

As of the record date, 480,328,006 shares of common stock were outstanding and entitled to be voted at the Annual Meeting. Holders of shares of our 5.5% Series A Non-Voting Perpetual Preferred Stock (the “Series A Preferred Stock”) are not entitled to vote such shares at the Annual Meeting.

Revoking Your Proxy or Changing Your Vote. Stockholders of record may revoke their proxy at any time before the electronic polls close by submitting a later-dated vote via the Internet, by telephone or by mail; by delivering instructions to our Secretary before the Annual Meeting commences; or by voting online in person during the Annual Meeting. Simply attending the meeting will not affect a vote that you have already submitted.

Beneficial stockholders may revoke any prior voting instructions by contacting the broker, bank, or other nominee that holds their shares prior to the Annual Meeting or by voting online during the meeting.

This Proxy Statement includes “forward-looking statements.” Such forward-looking statements are subject to a number of risks and uncertainties, many of which are not under Antero Midstream’s control. All statements, except for statements of historical fact, made in this Proxy Statement regarding activities, events or developments Antero Midstream expects, believes or anticipates will or may occur in the future, including statements regarding (1) ESG and sustainability-related activities; (2) our plans, strategies, initiatives, and objectives; (3) our assumptions, outlooks and expectations; (4) the scope and impact of our ESG risks and opportunities; and (5) standards, engagement, disclosure and expectations of third parties are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are aspirational and not guarantees or promises that they will be achieved. All forward-looking statements speak only as of the date hereof. Although Antero Midstream believes that the plans, intentions and expectations reflected in or suggested by the forward-looking statements are reasonable, there is no assurance that these plans, intentions or expectations will be achieved. Therefore, actual outcomes and results could materially differ from what is expressed, implied or forecast in such statements. Except as required by law, Antero Midstream expressly disclaims any obligation to and does not intend to publicly update or revise any forward-looking statements.

|

- 2024 Proxy Statement 11 |

The actual conduct of our activities, including the development, implementation, progress or continuation of any initiatives (including ESG and sustainability-related ones), commitments, strategies, and objectives, discussed or forecasted in this report may differ materially in the future. The reader should thus not place undue reliance on these forward-looking statements. In addition, many of the assumptions, standards, methodologies, statistics, metrics and measurements used in preparing this Proxy Statement, the 2022 ESG Report, and other ESG and sustainability-related information provided by the Company continue to evolve and are based on management’s beliefs, assumptions and expectations based on currently available information believed to be reasonable at the time of preparation but should not be considered guarantees. The standards, methodologies, statistics, metrics and measurements used, and the expectations and assumptions they are based on, have not been verified by any third party. Statistics, metrics and measurements relating to ESG matters are estimates and may be based on assumptions or developing standards. In some cases, the information is prepared, or based on information prepared, by governmental agencies, third-party vendors and consultants, or other third parties, and is not independently verified by Antero Midstream.

These statements are based on management’s beliefs, assumptions and expectations based on currently available information, are not guarantees of future performance, and are subject to risks, uncertainties and assumptions that are difficult to predict, including those identified in our most recent filings with the Securities and Exchange Commission (“SEC”) on Form 10-K and Form 10-Q. While we anticipate continuing to monitor and report on certain sustainability information, we cannot guarantee that such data will be consistent year-to-year, as methodologies and expectations continue to evolve and vary across companies, industries, jurisdictions and regulatory bodies. We hereby expressly disclaim any obligation or duty not otherwise required by legal, contractual, and other regulatory requirements to update, correct, provide additional details regarding, supplement, or continue providing such data, in any form, in future. Furthermore, there are sources of uncertainty and limitations that exist that are beyond our control and could impact the Company’s plans and timelines, including the reliance on technological and regulatory advancements and market participants’ behaviors and preferences.

In addition, while we seek to align these disclosures with the recommendations of various third-party frameworks, such as the Task Force on Climate-Related Financial Disclosures, we cannot guarantee strict adherence to these framework recommendations. Additionally, our disclosures based on these frameworks may change due to revisions in framework requirements, availability of information, changes in our business or applicable governmental policy, or other factors, some of which may be beyond our control. Moreover, with regards to our participation in, or certification under, various frameworks, we may incur certain costs associated with such frameworks and cannot guarantee that such participation or certification will have the intended results on our or our products’ ESG profile. In addition, the calculation of the methane leak loss rate disclosed in the 2022 ESG Report is based on ONE Future protocol, which is based on the EPA Greenhouse Gas Reporting Program currently in effect. We also calculate our Scope 1 GHG emissions in accordance with the EPA Greenhouse Gas Program, which is subject to change, and revisions to this program could result in the calculation of increased emissions from our operations, which in turn could impact our ability to realize Scope 1 and 2 GHG emission reductions on our proposed timeline. Scope 1 GHG emissions are the Company’s direct greenhouse gas emissions, and Scope 2 GHG emissions are the Company’s indirect greenhouse gas emissions associated with the purchase of electricity, steam, heat or cooling. Antero Midstream anticipates achieving a 100% reduction in pipeline maintenance emissions by 2025 and Net Zero Scope 1 and Scope 2 GHG emissions through 2050 through operational efficiencies and the purchase of carbon offsets; however, achieving such reductions is aspirational and we could face unexpected material costs as a result of our efforts to do so. Moreover, given uncertainties related to the use of emerging technologies, the state of markets for and availability of verified quality carbon offsets, we cannot predict whether or not we will be able to achieve these reductions in a timely fashion, if at all, or whether any offsets we purchase will ultimately achieve the emission reduction it represents.

|

- 2024 Proxy Statement 12 |

This Proxy Statement and the 2022 ESG Report contain statements based on hypothetical or severely adverse scenarios and assumptions, and these statements should not necessarily be viewed as being representative of current or actual risk or forecasts of expected risk. These scenarios cannot account for the entire realm of possible risks and have been selected based on what we believe to be a reasonable range of possible circumstances based on information currently available to us and the reasonableness of assumptions inherent in certain scenarios; however, our selection of scenarios may change over time as circumstances change. While future events discussed in this Proxy or the 2022 ESG Report may be significant, and with respect to which we may even use the word “material” or similar concepts of “materiality,” any potential significance should not be read as necessarily rising to the level of “materiality” of certain disclosures included in Antero Midstream’s SEC filings.

|

- 2024 Proxy Statement 13 |

The Board is currently comprised of nine directors, divided into three classes. Directors in each class are elected to serve for three-year terms and until they are re-elected, their successors are elected and qualified, or until his or her death or until they resign or are removed. Each year, the directors of one class stand for re-election as their terms of office expire.

Based on recommendations from our Nominating & Governance Committee, the Board has nominated the following individuals for election as Class II directors of Antero Midstream with terms to expire at the 2027 Annual Meeting of Stockholders, barring an earlier death, resignation or removal:

|

|

|

| Michael N. Kennedy | Brooks J. Klimley | John C. Mollenkopf |

Biographical information for the nominees is contained in “Directors” and “Executive Officers” below.

The Board has no reason to believe that any of its nominees will be unable or unwilling to serve if elected. If a nominee becomes unable or unwilling to accept nomination or election, either the size of the Board will be reduced or the individuals acting under your proxy will vote for the election of a substitute nominee recommended by the Board.

|

THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE FOR THE ELECTION OF EACH OF THE DIRECTOR NOMINEES. |

|

- 2024 Proxy Statement 14 |

We recognize the importance of diversity on our Board. Pursuant to our Diversity and Inclusion Policy and the Nominating and Governance Committee Charter, we view diversity broadly to include diversity of backgrounds, skills and viewpoints as well as traditional diversity concepts such as race, gender, national origin, religion or sexual orientation or identity. The Board believes that all directors should have sound business judgment, personal and professional integrity, an ability to work as part of a team, willingness to commit the required time to serve as a Board member, business experience, and financial literacy. The Nominating & Governance Committee considers diversity along with other factors when seeking an initial pool of qualified candidates for director nominees, and accordingly, our Diversity and Inclusion Policy requires that each initial pool of candidates to be considered to fill a vacancy on the Board shall include at least one individual who is considered diverse based on the traditional diversity concepts described therein.

As of the date hereof, the Board embodied a diverse set of experiences, qualifications, attributes, and skills, as shown below:

| Dea | Keenan | McArdle | Kennedy | Klimley | Mollenkopf | Rady | Chisholm | Keyte | |

| Executive Leadership |  |

|

|

|

|

|

|

|

|

| Financial |  |

|

|

|

|

|

|

| |

| Accounting/Audit |  |

|

|

|

| ||||

| Risk Management |  |

|

|

|

|

|

|

|

|

| Operations |  |

|

|

|

|

| |||

| Industry |  |

|

|

|

|

|

|

| |

| Environmental and/or Climate Change-Related |  |

|

|

|

|||||

| Health or Safety |  |

|

|

|

|||||

| Human Resources Management |  |

|

|

|

|

| |||

| Cybersecurity |  |

||||||||

| Racial/Ethnic Diversity | |||||||||

| Gender Diversity |  |

|

|

- 2024 Proxy Statement 15 |

We were originally formed in 2013 as Antero Resources Midstream Management LLC to become the general partner of Antero Midstream Partners LP. In 2017, Antero Resources Midstream Management LLC converted from a limited liability company to a limited partnership under the laws of the State of Delaware, and changed its name to Antero Midstream GP LP in connection with its initial public offering. In March 2019, Antero Midstream GP LP was converted from a limited partnership to a corporation under the laws of the State of Delaware and changed its name to Antero Midstream Corporation. Other than Messrs. Keyte and Kennedy and Mses. McArdle and Chisholm, who were appointed to the Board in April 2019, April 2021, March 2020 and December 2022, respectively, each of our existing directors was appointed to the Board in connection with the closing of the simplification transactions (the “Simplification Transactions”) in March 2019.

Set forth below is the background, business experience, attributes, qualifications and skills of each Antero Midstream director and director nominee.

Each of the Class II directors is up for reelection at the Annual Meeting.

|

Age: 70 Director Since: Committee Memberships: Compensation Committee, Conflicts Committee |

Peter

A. Dea | |

|

Key Skills, Attributes and Qualifications: • Co-Founder and Executive Chairman of Confluence Resources LP, since the company’s inception in September 2016 • Co-Founder, President and CEO of Cirque Resources LP since its inception in May 2007 • President, CEO and Director of Western Gas Resources, Inc. from 2001 through their merger with Anadarko Petroleum Corporation in 2006 • CEO from 1999 and Chairman of the Board from 2000 of Barrett Resources Corporation until its sale in 2001 to Williams Companies • Served as a director of the general partner of Antero Midstream GP LP from April 2018 through the closing of the Simplification Transactions Has over 40 years of oil and gas exploration and production experience and involvement in national and state energy policies Other Public Company Boards: • Ovintiv Corporation; Liberty Energy Inc. |

|

- 2024 Proxy Statement 16 |

|

Age: 73 Director Since: Committee Memberships: |

W.

Howard Keenan, Jr. | |

|

Key Skills, Attributes and Qualifications: • Since 1997, has been a Member of Yorktown Partners LLC, a private investment manager focused on the energy industry • From 1975 to 1997, was in the Corporate Finance Department of Dillon, Read & Co. Inc. and active in the private equity and energy areas, including the founding of the first Yorktown Partners fund in 1991 • Serves on the boards of directors of multiple Yorktown Partners portfolio companies • Serves on the Board of Directors of Antero Resources • Served as a director of the general partner of Antero Midstream GP LP beginning in April 2017 and as a director of the general partner of Antero Midstream Partners LP beginning in February 2014, in each case, through the closing of the Simplification Transactions Has over 40 years of experience with energy companies and investments and broad knowledge of the oil and gas industry. Other Public Company Boards: • Solaris Oilfield Infrastructure, Inc.; Aris Water Solutions; Antero Resources; Brigham Minerals, Inc. (until January 2022); Ramaco Resources, Inc. (until June 2019); Concho Resources (until 2013); Geomet Inc. (until 2012) |

Age: 63 Director Since: 2020 Committee Memberships: Audit Committee, Environmental, Social and Governance (ESG) Committee |

Janine

J. McArdle | |

|

Key Skills, Attributes and Qualifications: • Founder and Chief Executive Officer of Apex Strategies, LLC, a global consultancy company providing advisory services to midstream and downstream energy companies, since 2016 • Executive of Apache Corporation from 2002 to 2015 serving most recently as Senior Vice President –Global Gas Monetization and President of Kitimat LNG • Served as President and Managing Director for Aquila Europe Ltd. from 2001 to 2002 and served in various executive and trading roles prior thereto Has over 30 years of experience as an executive in the oil and gas industry with extensive background in engineering, marketing, business development, finance and risk management. Other Public Company Boards: • Santos Ltd; Advantage Energy Ltd; Halcon Resources Corporation (until 2019) |

|

- 2024 Proxy Statement 17 |

|

Age: 49 Director Since: Committee Memberships: |

Michael

N. Kennedy | |

|

Key Skills, Attributes and Qualifications: • Currently serves as Senior Vice President—Finance of Antero Midstream and Chief Financial Officer and Senior Vice President—Finance of Antero Resources Corporation • Served as Chief Financial Officer of Antero Midstream from the closing of the Simplification Transactions in March 2019 until April 30, 2021, prior to which Mr. Kennedy served as Chief Financial Officer and Senior Vice President of Finance of the general partner of Antero Midstream GP LP beginning in April 2017 and as Chief Financial Officer and Senior Vice President of Finance of the general partner of Antero Midstream Partners LP beginning in February 2014 • Served as Antero Resources’ Senior Vice President of Finance beginning in January 2016, prior to which he served as Vice President of Finance beginning in August 2013 • Served as Executive Vice President and Chief Financial Officer of Forest Oil Corporation from 2009 to 2013 and served in various financial positions prior thereto • Served as an auditor with Arthur Andersen, focusing on the Natural Resources industry Has significant experience as Former Chief Financial Officer and current Senior Vice President of Finance of Antero Midstream, together with his broad knowledge and experience in the industry. Other Public Company Boards: • N/A | ||

|

Age: 67 Director Since: Committee Memberships: |

Brooks

J. Klimley | |

|

Key Skills, Attributes and Qualifications: • President of Brooks J. Klimley & Associates, an energy advisory services firm focused on corporate strategy, governance and finance for public and private energy, power and infrastructure companies • Currently serves as a director and chair of the Audit and Risk Committees for Third Coast Super Holdings, LLC • Currently serves as director of Jaguar Exploración y Producción • Adjunct Professor of Finance and Economics at Columbia University’s School of International and Public Affairs teaching “Energy and Power Financing Markets: The Quest for Sustainable Development” • From 2013 to 2019, served as Managing Director and Head of Energy & Natural Resources at The Silverfern Group • Over 30 years of experience leading investment banking and private equity practices focused on the energy and natural resources sectors • Served as a director of the general partner of Antero Midstream GP LP beginning in 2017, and as a director of the general partner of Antero Midstream Partners LP from March 2015 to 2017, in each case, through the closing of the Simplification Transactions Has significant experience in the public and private upstream and midstream oil and gas industry. Other Public Company Boards: • N/A |

|

- 2024 Proxy Statement 18 |

|

Age: 62 Director Since: Committee Memberships: |

John

C. Mollenkopf | |

|

Key Skills, Attributes and Qualifications: • Prior to his retirement in 2016, served as Executive Vice President and Chief Operating Officer for MarkWest operations of MPLX GP LLC • In 2002, was one of five founders of MarkWest Energy Partners, L.P., and until 2015, served as Executive Vice President and Chief Operating Officer • From 1996 to 2002, worked in various senior management roles for MarkWest Hydrocarbon, Inc. • From 1982 to 1996, worked for ARCO Oil and Gas Company in various roles in engineering and operations • Served as a director of the general partner of Antero Midstream GP LP beginning in April 2017 through the closing of the Simplification Transactions Has significant experience in executive management, business development, marketing, engineering and operations in the oil and gas industry. Other Public Company Boards: • N/A |

|

Age: 70 Director Since: Chairman, |

Paul

M. Rady | |

|

Key Skills, Attributes and Qualifications: • Currently serves as Chairman, Chief Executive Officer and President of Antero Midstream and Antero Resources • Served as Chief Executive Officer and Chairman of Antero Midstream since the closing of the Simplification Transactions, prior to which Mr. Rady served as (i) Chief Executive Officer of the general partner of Antero Midstream GP LP beginning in January 2017; (ii) as Chairman of the board of directors of such entity beginning in April 2017; and (iii) as Chief Executive Officer and Chairman of the board of directors of the general partner of Antero Midstream Partners LP beginning in February 2014 • Co-founder of Antero Resources Corporation, serving as Chairman of the Board of Directors and Chief Executive Officer of Antero Resources since May 2004 • Served as Chief Executive Officer and Chairman of Antero Resources Corporation’s predecessor company from its founding in 2002 to its ultimate sale to XTO Energy, Inc. in 2005 • Served as President, CEO and Chairman of Pennaco Energy from 1998 until its sale to Marathon in 2001 • Worked with Barrett Resources Corporation from 1990 until 1998, moving from Chief Geologist; to Exploration Manager; EVP Exploration; President, COO and Director; and ultimately CEO • Began his career with Amoco Corporation, where he served ten years as a geologist focused on the Rockies and Mid-Continent Has significant experience as a chief executive of oil and gas companies, together with his training as a geologist and broad industry knowledge. Other Public Company Boards: • Antero Resources |

|

- 2024 Proxy Statement 19 |

|

Age: 57 Director Since: Committee Memberships: |

Nancy

E. Chisholm | |

|

Key Skills, Attributes and Qualifications: • Served for 20 years in various roles at Tyco International (acquired by Johnson Controls Inc), between 1996 and 2017 • Most recently served as President of Tyco Retail Solutions, a global business unit focused on technologies that serve the retail sector in over 70 countries • Former Vice President, Human Resources for Tyco’s ADT Security Solutions global business unit • Previously Vice President and General Manager of ADT’s Western Region in North America • Served as Trustee for Western Colorado University from 2013 and Interim President from 2021 to 2022 • Current Board Member at Envera Systems, LLC, a privately held electronic security company Has significant experience in operational leadership and human resources. Other Public Company Boards: • N/A |

|

Age: 68 Director Since: Committee Memberships: |

David

H. Keyte (Lead Director) | |

|

Key Skills, Attributes and Qualifications: • Co-founder, serving as Chairman and Chief Executive Officer of Caerus Oil and Gas LLC since 2009 • Served as Chief Financial Officer of Forest Oil Corporation from 1995 to 2009 and various financial positions from 1987 to 1995 Has more than 40 years of experience in executive management and finance in the oil and gas industry. Other Public Company Boards: • Regal Entertainment Group (until 2018)

|

|

- 2024 Proxy Statement 20 |

The table below sets forth the name, age and principal position of each of our executive officers as of December 31, 2023.

| Name | Age | Principal Position | ||

| Paul M. Rady | 70 | Chairman of the Board, Chief Executive Officer and President | ||

| Michael N. Kennedy | 49 | Director and Senior Vice President—Finance | ||

| Yvette K. Schultz | 42 | Chief Compliance Officer, Senior Vice President—Legal, General Counsel and Corporate Secretary | ||

| Brendan E. Krueger | 39 | Chief Financial Officer, Vice President – Finance and Treasurer |

Biographical information for Messrs. Rady and Kennedy is set forth under “Directors” above. References to a position held by one of the below officers at “Antero” means that the person held such position at Antero Resources Corporation, Antero Midstream, the general partner of Antero Midstream GP LP, and the general partner of Antero Midstream Partners LP, as applicable.

Yvette K. Schultz has served as Chief Compliance Officer and Senior Vice President of Legal since January 2022, and as General Counsel since January 2017. Ms. Schultz has also served as Corporate Secretary since April 2021. Ms. Schultz was previously Antero’s Director of Legal from 2015 to 2017. Prior to joining Antero, Ms. Schultz was an attorney at Vinson & Elkins LLP from 2008 to 2012 and at Latham & Watkins LLP from 2012 to 2015. Ms. Schultz earned her Bachelor of Science degree magna cum laude in Computer Science from the University of South Dakota in 2004 and her Masters in Business Administration degree from the University of South Dakota in 2005. She also attended the Paul M. Hebert Law Center at Louisiana State University where she graduated valedictorian and earned both her J.D. and B.C.L. degrees summa cum laude in 2008.

Brendan E. Krueger has served as Antero Midstream’s Chief Financial Officer since April 2021. Mr. Krueger has also served as Antero’s Vice President – Finance since April 2018. In addition to his current role, he has served as Antero’s Treasurer since December 2019. Mr. Krueger previously served as Antero’s Finance Director from 2016 to 2018 and Antero’s Finance Manager from 2014 to 2016. Prior to joining Antero, Mr. Krueger spent seven years as an investment banker focused on equity and debt financing and mergers and acquisition advisory with Robert W. Baird & Co., Wells Fargo Securities, and A.G. Edwards, Inc. from 2007 through 2014. Mr. Krueger earned his Bachelor of Business Administration in finance from the University of Notre Dame.

|

- 2024 Proxy Statement 21 |

Antero Midstream’s sound governance practices and policies provide an important framework to assist the Board in fulfilling its duties to stockholders. The Corporate Governance Guidelines include provisions concerning the following:

| • | qualifications, independence, responsibilities, tenure, and compensation of directors; |

| • | background (including skills, experience and viewpoint) and diversity (including race, gender, national origin, religion, and sexual orientation or identity) of directors, pursuant to Antero Midstream’s Diversity and Inclusion Policy; |

| • | service on other boards; |

| • | director resignation process; |

| • | role of the Chairman of the Board and the Lead Director; |

| • | meetings of the Board and of the independent directors; |

| • | interaction between the Board and outside parties; |

| • | annual performance reviews of the Board; |

| • | director orientation and continuing education; |

| • | attendance at meetings of the Board and the Annual Meeting; |

| • | stockholder communications with directors; |

| • | committee functions, committee charters, and independence; |

| • | director access to independent advisors and management; and |

| • | management evaluation and succession planning. |

The Corporate Governance Guidelines are available on Antero Midstream’s website at www.anteromidstream.com in the “Governance” subsection of the “Investors” section. The Nominating & Governance Committee reviews the Corporate Governance Guidelines periodically and as necessary, and any proposed additions or amendments are presented to the Board for its approval.

Rather than adopting categorical standards, the Board assesses director independence on a case-by-case basis, in each case consistent with applicable legal requirements and the listing standards of the New York Stock Exchange (NYSE). After reviewing all relationships each director has with Antero Midstream, including the nature and extent of any business relationships, as well as any significant charitable contributions made to organizations where directors serve as board members or executive officers, the Board has affirmatively determined that none of the directors have material relationships with Antero Midstream and all of them are independent as defined by NYSE listing standards except Mr. Rady, Antero Midstream’s Chief Executive Officer and President, and Mr. Kennedy, Antero Midstream’s Senior Vice President of Finance.

7of 9 Directors are Independent |

|

- 2024 Proxy Statement 22 |

Antero Midstream does not have a formal policy addressing whether the roles of Chairman of the Board and Chief Executive Officer should be separate or combined. The directors serving on the Board have considerable professional and industry experience, significant experience as directors of both public and private companies, and a unique understanding of the challenges and opportunities Antero Midstream faces. Accordingly, the Board believes it is in the best position to evaluate Antero Midstream’s needs and to determine how best to organize its leadership structure to meet those needs at any given time.

At present, the Board has chosen to combine the positions of Chairman and Chief Executive Officer. The Board believes the current Chief Executive Officer is the individual with the necessary experience, commitment, and support of the other members of the Board to effectively carry out the role of Chairman. Mr. Rady brings valuable insight to the Board due to the perspective and experience he has gained as our Chief Executive Officer and as one of our founders. As the principal executive officer since our inception, Mr. Rady has unparalleled knowledge of our business and operations. As a significant stockholder, Mr. Rady is invested in our long-term success. In addition, the Board believes that combining the roles of Chairman and Chief Executive Officer at the present time promotes strong alignment of strategic development and execution, effective implementation of strategic initiatives, and clear accountability for Antero Midstream’s success. Because seven of the nine directors are independent under NYSE rules, the Board believes this leadership structure does not impede independent oversight of Antero Midstream.

The Nominating & Governance Committee reviews this leadership structure every year. Subject to the terms of the Stockholders’ Agreement, the Board believes it is important to retain the flexibility to determine whether the roles of Chairman and Chief Executive Officer should be separated or combined.

To facilitate candid discussion among Antero Midstream’s directors, the non-management directors meet regularly in executive sessions.

The Corporate Governance Guidelines permit the Board, on the recommendation of the Nominating & Governance Committee, to choose a Lead Director to preside at these executive sessions. The Lead Director’s responsibilities include:

|

BOARD LEADERSHIP • Presiding over the non-management executive session held at each Board meeting

• Calling meetings of the independent directors, as needed

• Conferring with the committee chairs and the Chairman, where appropriate, on agenda planning to ensure coverage of key strategic issues

• Facilitating the Board’s ability to periodically review and provide input on and monitor management’s execution of the company’s long-term strategy

• Serving as the independent directors’ representative in crisis situations

• Acting as a key advisor to the CEO on a wide variety of company matters

• Being authorized, in consultation with the Board, to retain independent advisors

• Engaging directly with key members of the leadership team

• Participating in Board-level enterprise risk management |

BOARD CULTURE • Serving as liaison between the Chairman and the independent directors

• Facilitating discussion among the independent directors on key issues and concerns

• Facilitating Board discussions that demonstrate constructive questioning of management

• Promoting teamwork and communication among the independent directors

• Fostering an environment that allows for engagement and commitment of Board members | |

|

BOARD MEETINGS • Presiding at all meetings or executive sessions of the Board at which the Chairman is not present | ||

|

PERFORMANCE AND DEVELOPMENT • Leading, in conjunction with the Compensation Committee, the annual performance assessment of the CEO

• Facilitating the Board’s engagement with the CEO and CEO succession planning

• Leading the Board’s annual self- assessment and recommendations for improvement, if any |

SHAREHOLDER ENGAGEMENT • Ensuring that he or she is available for direct engagement on matters related to Board governance and oversight, if requested by major shareholders

• Ensuring appropriate board oversight of key stakeholder and investor engagement and disclosures | |

|

- 2024 Proxy Statement 23 |

Mr. Keyte has served in this role since 2019, chairing executive sessions of the non-management directors and establishing the agenda for these meetings.

As the Lead Director, Mr. Keyte joins the Chairman in providing leadership and guidance to the Board.

Subject to the terms of the Stockholders’ Agreement, before recommending to the Board that an existing director be nominated for reelection at the annual meeting of stockholders, the Nominating & Governance Committee will review and consider the director’s:

•

past Board and committee meeting attendance and performance;

•

length of Board service;

•

personal and professional integrity, including commitment to Antero Midstream’s core values;

•

relevant experience, skills, qualifications and contributions to the Board; and

•

independence under applicable standards.

The Nominating & Governance Committee is responsible for assessing the appropriate balance of skills and characteristics required of Board members.

The Board believes that all directors should have sound business judgment, personal and professional integrity, an ability to work as part of a team, willingness to commit the required time to serve as a Board member, business experience, and financial literacy. The Nominating & Governance Committee considers diversity of background and experience along with other factors when reviewing director candidates.

For information regarding the experiences, qualifications, attributes, and skills of the current members of our Board, please see “Proxy Summary—Summary of Director Qualifications and Experience.”

The Nominating & Governance Committee will treat informal recommendations for directors that are received from Antero Midstream’s stockholders in the same manner as recommendations received from any other source. The Nominating & Governance Committee and the Board will also consider the benefits of all aspects of diversity, and will consider whether, and if so how, to identify new candidates for Board service and when identifying potential new Board members or filing a vacancy on the Board, commits to seeking out diverse candidates to the extent possible. Our Diversity and Inclusion Policy requires that each initial pool of candidates to be considered to fill a vacancy on the Board shall include at least one individual who is considered diverse based on the traditional diversity concepts described therein.

|

- 2024 Proxy Statement 24 |

In the normal course of its business, Antero Midstream is exposed to a variety of risks, including its ability to execute its business strategy, competition, governmental regulations, interest rate risks, cybersecurity risks, and credit and investment risk, as well as risks relating to Antero Resources’ ability to meet its drilling and development plan. Our Board reviews risks that the Company faces in the short-, intermediate- and long-term timeframe in relation to our business on a regular basis. At least annually, our Board also receives updates from management regarding information security, cybersecurity and data security risks in connection with Antero Midstream’s Enterprise Risk Management program. The Board and each committee has distinct responsibilities for monitoring other risks, as shown below.

|

The Board of Directors The Board oversees Antero Midstream’s strategic direction. To that end, the Board considers the potential rewards and risks of Antero Midstream’s business opportunities and challenges, and it monitors the development and management of risks that impact our strategic goals. |

|

Audit Committee The Audit Committee monitors the effectiveness of Antero Midstream’s systems of financial reporting, auditing and internal controls, as well as related legal and regulatory compliance and cybersecurity matters, including ESG disclosures in our quarterly and annual SEC reports, Antero Midstream’s privacy and cybersecurity risk exposures, as well as plans and activities to monitor and mitigate such risks. |

Nominating & Governance Committee The Nominating & Governance Committee oversees the management of risks associated with Board organization, membership and structure; succession planning for our directors and executive officers; and corporate governance. |

Compensation Committee The Compensation Committee oversees Antero Midstream’s compensation policies and practices. |

Environmental, Social and Governance (ESG) Committee The Environmental, Social and Governance (ESG) Committee provides guidance to the Board on, and oversees Antero Midstream’s risk management policies related to, the ESG matters. The ESG Committee regularly receives reports from management on pertinent ESG risks or opportunities, including climate related topics. |

Conflicts Committee The Conflicts Committee assists the Board in investigating, reviewing and evaluating potential conflicts of interest, including those between Antero Midstream and Antero Resources. |

The Board believes that a robust and constructive evaluation process is an essential component of Board effectiveness and good corporate governance. To that end, the Board, the Audit Committee, the Compensation Committee, the Nominating & Governance Committee and the ESG Committee each conduct an annual self-assessment to evaluate their performance, composition, and effectiveness, and to identify areas for improvement.

These evaluations take the form of wide-ranging and candid discussions. The Lead Director facilitates discussions evaluating the full Board, and the committee chairs facilitate discussions regarding their respective committees.

|

- 2024 Proxy Statement 25 |

Directors are elected by a plurality of votes cast in an uncontested election. The Corporate Governance Guidelines require that an incumbent director who fails to receive more votes cast “for” than “withheld” must tender a resignation. The Nominating & Governance Committee will act on an expedited basis to determine whether to accept any such resignation, and will submit its recommendation for prompt consideration by the Board. The Board expects the director whose resignation is under consideration to abstain from participating in this decision. The Nominating & Governance Committee and the Board may consider any factors they deem relevant in deciding whether to accept a director’s resignation.

The Board held 9 meetings in 2023. The outside directors held 4 executive sessions. No director attended fewer than 75% of the meetings of the Board and of the committees of the Board on which that director served during the respective time he or she served.

Directors are encouraged to attend the Annual Meetings of Stockholders. All of the members of the Board attended the 2023 Annual Meeting.

Stockholders and other interested parties may communicate with us by writing to Antero Midstream Corporation, 1615 Wynkoop Street, Denver, Colorado 80202. Stockholders may submit their thoughts to the Board, any committee of the Board, or individual directors on a confidential or anonymous basis by sending the communication in a sealed envelope marked “Stockholder Communication with Directors” and clearly identifying the intended recipient(s).

Antero Midstream’s Chief Compliance Officer and Corporate Secretary will review and forward each communication, as soon as reasonably practicable, to the addressee(s) if the communication falls within the scope of matters generally considered by the Board. To the extent the subject matter of a communication is appropriate and relates to matters that have been delegated by the Board to a committee other than the addressee(s) or to an executive officer, the Chief Compliance Officer and Corporate Secretary also may forward the communication to the applicable officer or committee chair.

Information regarding legal or compliance concerns may be submitted confidentially and anonymously, although Antero Midstream may be obligated by law to disclose the information or identity of the person providing the information in connection with government or private legal actions and in other circumstances. Antero Midstream’s policy is not to take any adverse action, and not to tolerate any retaliation, against any person for asking questions or making good faith reports of possible violations of law, Antero Midstream’s policies or our Corporate Code of Business Conduct and Ethics.

|

- 2024 Proxy Statement 26 |

Antero Midstream’s Insider Trading Policy, which applies to all employees, officers, and directors, prohibits hedging of Antero Midstream securities and engaging in any other transactions involving Antero Midstream-based derivative securities, regardless of whether the covered person is in possession of material, non-public information. The policy does not affect certain transactions made pursuant to Antero Midstream’s incentive, retirement, stock purchase, or dividend reinvestment plans, or other transactions involving purchases and sales of company securities between a covered person and Antero Midstream. Antero Midstream’s Insider Trading Policy also prohibits purchasing Antero Midstream common stock, par value $0.01 per share (“Antero Midstream Common Stock”), on margin (e.g., borrowing money to fund the stock purchase) and pledging Antero Midstream securities.

The following materials are available on Antero Midstream’s website at www.anteromidstream.com under “Investors” and then “Governance—Governance Documents.”

•

Certificate of Incorporation of Antero Midstream

•

Bylaws of Antero Midstream

•

Charters of the Audit Committee, the Compensation Committee, the Nominating & Governance Committee, and the Environmental, Social and Governance Committee;

•

Corporate Code of Business Conduct and Ethics;

•

Financial Code of Ethics;

•

Corporate Governance Guidelines;

•

Human, Labor and Indigenous Rights Policy;

•

Diversity and Inclusion Policy;

•

Supplier Code of Conduct;

•

Whistleblower Policy;

•

Political Advocacy Policy; and

•

Biodiversity Policy

Stockholders may obtain a copy, free of charge, of any of these documents by sending a written request to Antero Midstream Corporation, 1615 Wynkoop Street, Denver, Colorado, 80202. Any amendments to Antero Midstream’s Corporate Code of Business Conduct and Ethics will be posted in the “Governance” subsection of our website.

The Board had five standing committees in 2023: the Audit Committee, the Compensation Committee, the Nominating & Governance Committee, the Conflicts Committee and the Environmental, Social and Governance (ESG) Committee. Committee charters are available on Antero Midstream’s website at www.anteromidstream.com in the “Governance—Governance Documents” subsection of the “Investors” section.

|

- 2024 Proxy Statement 27 |

Audit Committee

Current Members: David H. Keyte (chair) Nancy E. Chisholm Brooks J. Klimley Janine J. McArdle John C. Mollenkopf

Number of meetings in 2023: 5

|

The Audit Committee oversees, reviews, acts on, and reports to the Board on various audit and accounting matters, including:

• the selection of Antero Midstream’s independent accountants, • the scope of annual audits, • fees to be paid to the independent accountants, • the performance of Antero Midstream’s independent accountants, and • Antero Midstream’s accounting practices.

In addition, the Audit Committee oversees Antero Midstream’s compliance with legal and regulatory requirements relating to financial, accounting, auditing and related compliance matters, including ESG disclosures in our quarterly and annual SEC reports, as well as Antero Midstream’s privacy and cybersecurity risk exposures, and its plans and activities to monitor and mitigate such risks.

The Board has determined that all members of the Audit Committee meet the heightened independence standards applicable to audit committee members prescribed by rules of the NYSE and the SEC. In addition, the Board believes Mr. Keyte is an “audit committee financial expert” as defined in SEC rules. |

Compensation Committee

Current Members: David H. Keyte (chair) Peter A. Dea W. Howard Keenan, Jr.

Number of meetings in 2023: 5

|

The Compensation Committee establishes salaries, incentives and other forms of compensation for our executive officers. The Compensation Committee also administers Antero Midstream’s incentive compensation and benefit plans, and reviews and recommends to the Board for approval the compensation of our non-employee directors.

The Board has determined that all members of the Compensation Committee meet the NYSE’s heightened requirements applicable to compensation committee members, and also meet the heightened independence requirements under SEC rules and the tax code. No Antero Midstream executive officer serves on the board of directors of a company that has an executive officer who serves on the Board. |

|

- 2024 Proxy Statement 28 |

Nominating & Governance Committee

Current Members: Brooks J. Klimley (chair) W. Howard Keenan, Jr. David H. Keyte

Number of meetings in 2023: 4 |

The Nominating & Governance Committee identifies, evaluates and recommends qualified nominees to serve on the Board, develops and oversees Antero Midstream’s internal corporate governance processes, and directs all matters relating to the succession of Antero Midstream’s Chief Executive Officer.

The Board has determined that all members of the Nominating & Governance Committee meet the NYSE’s independence standards. |

Conflicts Committee

Current Members: David H. Keyte (chair) Peter A. Dea

Number of meetings in 2023: 1 |

The Conflicts Committee assists the Board in investigating, reviewing and evaluating certain potential conflicts of interest, including those between Antero Midstream and Antero Resources, and carries out any other duties delegated by the Board that relate to potential conflict matters. |

Environmental, Social and Governance (ESG) Committee

Current Members: Brooks J. Klimley (chair) Nancy E. Chisholm Michael N. Kennedy Janine J. McArdle John C. Mollenkopf

Number of meetings in 2023: 4

|

The Environmental, Social and Governance (ESG) Committee provides guidance to the Board on, and oversees Antero Midstream’s risk management policies related to the ESG matters.

Members of the ESG Committee have experience in areas relating to ESG, including environmental stewardship, social responsibility and community relations. Brooks Klimley, the ESG Committee Chair, brings experience from his career leading investment banking practices covering the energy and mining sectors. Mr. Klimley also serves as an Adjunct Professor at Columbia University’s School of International and Public Affairs. Janine McArdle has more than 30 years of experience in engineering, marketing, business development, finance and risk management. John Mollenkopf has significant experience in executive management, business development, marketing, engineering, operations and environmental, health and safety in the midstream energy sector. Michael Kennedy was an auditor with Arthur Andersen focusing on the Natural Resources industry.

During 2023, the ESG Committee reviewed, and the Company published, its published its 2022 ESG Report, which is available at www.anteromidstream.com/community-sustainability.

|

|

- 2024 Proxy Statement 29 |

Our non-employee directors are entitled to receive compensation consisting of retainers, fees and equity awards as described below. The Compensation Committee reviews non-employee director compensation periodically and recommends changes, if appropriate, to the Board for approval.

Our employee directors do not receive additional compensation for their services as directors. All compensation received from Antero Midstream as employees is disclosed in the Summary Compensation Table on page 50.

Effective April 15, 2023, some of the annual retainers payable to non-employee directors of the Board were increased slightly, as indicated below. These modifications were made to ensure that our director compensation is competitive with that paid by our peers so that we can attract and retain qualified individuals to serve on our Board.

| Recipient | Amount | |||

| Non-employee director | $ | 107,500 (previously $97,500) |

||

| Lead Director | $ | 32,500 (previously $25,000) |

||

| Audit Committee: | ||||

| Chairperson | $ | 27,500 (previously $24,000) |

||

| Other members | $ | 15,000 | ||

| Compensation Committee: | ||||

| Chairperson | $ | 20,000 (previously $15,000) |

||

| Other members | $ | 7,500 | ||

| Nominating & Governance and ESG Committees: | ||||

| Chairperson | $ | 15,000 | ||

| Other members | $ | 7,500 | ||

| Conflicts Committee: | ||||

| Chairperson | $ | 7,500 | ||

| Other members | $ | 7,500 |

All retainers are paid in cash on a quarterly basis in arrears, but directors have the option to elect, on an annual basis, to receive all or a portion of their cash retainers in the form of shares of our common stock.

In addition to cash compensation, our non-employee directors receive annual equity-based compensation consisting of fully-vested stock with an aggregate grant date value equal to $142,500 (increased from $130,000), subject to the terms and conditions of the Antero Midstream Corporation Long Term Incentive Plan (“AM LTIP”) and the agreements pursuant to which such awards are granted. These awards are granted in arrears on a quarterly basis, so each installment has a grant date fair value of approximately $35,625. Prior to April 15, 2023, the annual equity-based compensation for non-employee directors had an aggregate grant date value of $130,000, such that the first two installments paid to each director in 2023 had a grant date fair value of approximately $32,500.

|

- 2024 Proxy Statement 30 |